Making Finance Smarter: QuickBooks to Dynamics 365 Business Central Migration

Section

Table of Contents

- Why Businesses Move Away from QuickBooks

- What is Microsoft Dynamics 365 Business Central?

- Key Advantages of Migrating to Business Central

- QuickBooks to Dynamics 365 Migration Process: Step-by-Step

- Common Migration Challenges and How to Overcome Them

- Expected Business Impact After Migration

- Conclusion

- FAQs ( Frequently Asked Questions)

Modern digital financial management software is vital for organizations looking to ensure fool-proof accuracy in financial processes and robust operational controls. Microsoft Dynamics 365 Business Central is an integrated solution that unifies finance, operations, sales, and customer service within one platform. This solution is designed for businesses that require a high degree of reliability and technical precision across their core functions.

Many enterprises begin with systems such as QuickBooks, which is widely adopted by small and medium-sized businesses for its ease of use. However, as companies grow, the QuickBooks limitations become apparent. When handling an increasing volume of transactions, managing multiple currencies, or requiring detailed analytics, the initial capabilities of QuickBooks often fall short. Organizations in need of QuickBooks’ advanced reporting features find that the tool does not support the level of detail needed for strategic decision-making.

This shortfall in functionality prompts businesses to consider migrating from QuickBooks to Dynamics 365 Business Central. The migration from accounting-only software like QuickBooks to a more rounded ERP solutions like Business Central has several advantages for small and medium-sized organizations. The Business Central integrations with other Microsoft applications such as Office 365 and Power BI offer high-level executives, including CEOs and CMOs, a unified platform for accurate financial reporting and operational insights.

Why Businesses Move Away from QuickBooks

As organizations expand their operations and transaction volumes, many find that accounting-only software like QuickBooks no longer meets their growing technical and operational needs. Especially for manufacturing and retail operations as raw material, stocks, and distribution grow, managing inventory, orders, and logistics without scalable systems can limit efficiency.

Some specific challenges in this regard include:

- Transaction Volume and Data Integrity: QuickBooks often faces issues with high transaction volumes. Its architecture may lead to data integrity problems when dealing with large-scale operations, impacting accuracy in financial reporting. This limitation is especially critical for companies processing a significant number of transactions daily, where even minor discrepancies can accumulate over time.

- Advanced Reporting Needs: Although QuickBooks offers basic reporting, it lacks QuickBooks’ advanced reporting capabilities necessary for in-depth financial analysis and strategic decision-making. The lack of customizable reports hinders executives from gaining a detailed, real-time view of financial performance across various departments or business units.

- Multi-Entity and Multi-Currency Complexity: As companies expand internationally or develop multiple subsidiaries, QuickBooks’ functionality can fall short. Its multi-entity and multi-currency management features are limited, making it challenging to consolidate financial data and comply with diverse regulatory requirements.

- Integration and Automation Gaps: QuickBooks is often unable to integrate smoothly with other modern business applications. In contrast, Business Central integrations with Microsoft’s suite of products enable seamless data flow between finance, operations, and customer engagement systems. This integration minimizes manual data entry and reduces errors in critical workflows.

- Security and Compliance Concerns: With evolving industry standards and regulatory requirements, maintaining robust security measures is paramount. QuickBooks does not always provide the advanced security features required for sensitive financial data, making it less suitable for organizations with stringent compliance needs.

Switch from QuickBooks to Business Central. Consult Us.

What is Microsoft Dynamics 365 Business Central?

Microsoft Dynamics 365 Business Central is a cloud-based ERP solution designed for small and mid-sized organizations. According to Microsoft’s official documentation, the Dynamics 365 Business Central system centralizes core business processes—including finance, sales, service, and operations—on a single platform built on Microsoft Azure. The system offers built-in financial management, inventory, project, and manufacturing functionalities, all configured to support complex operations across multiple entities and currencies.

The Dynamics 365 Business Central overview highlights that the solution provides real-time insights into operational and financial data. This capability is achieved by consolidating data from various sources into a unified platform. Advanced reporting features, referred to as QuickBooks advanced reporting in comparison to the limitations of entry-level tools, allow executives to generate detailed financial statements and performance metrics that surpass QuickBooks limitations.

Business Central integrations with other Microsoft products such as Microsoft 365, Power BI, and the Microsoft Power Platform are key components. These Business Central integrations enable users to access data from familiar applications like Outlook, Excel, and Teams, thereby reducing the manual effort in generating reports and managing workflows. The system’s role-based dashboards and AI-assisted tools—available through Microsoft Copilot—further support precise financial tracking and operational reporting.

For companies planning a QuickBooks to Dynamics 365 migration or a QuickBooks to Business Central transition, the benefits of Business Central include scalability to handle increased transaction volumes and multi-entity complexities. The solution addresses QuickBooks limitations by providing robust data management, improved financial accuracy, and a wide array of customizable reporting options. This technical capability makes it possible for high-level decision makers to have a detailed view of their operations, supporting strategic business planning.

The benefits of Business Central are also reflected in its integration with cloud security and compliance standards set by Microsoft. This gives organizations confidence in the accuracy and security of their financial data—a critical factor when moving from traditional accounting software to a modern ERP solution.

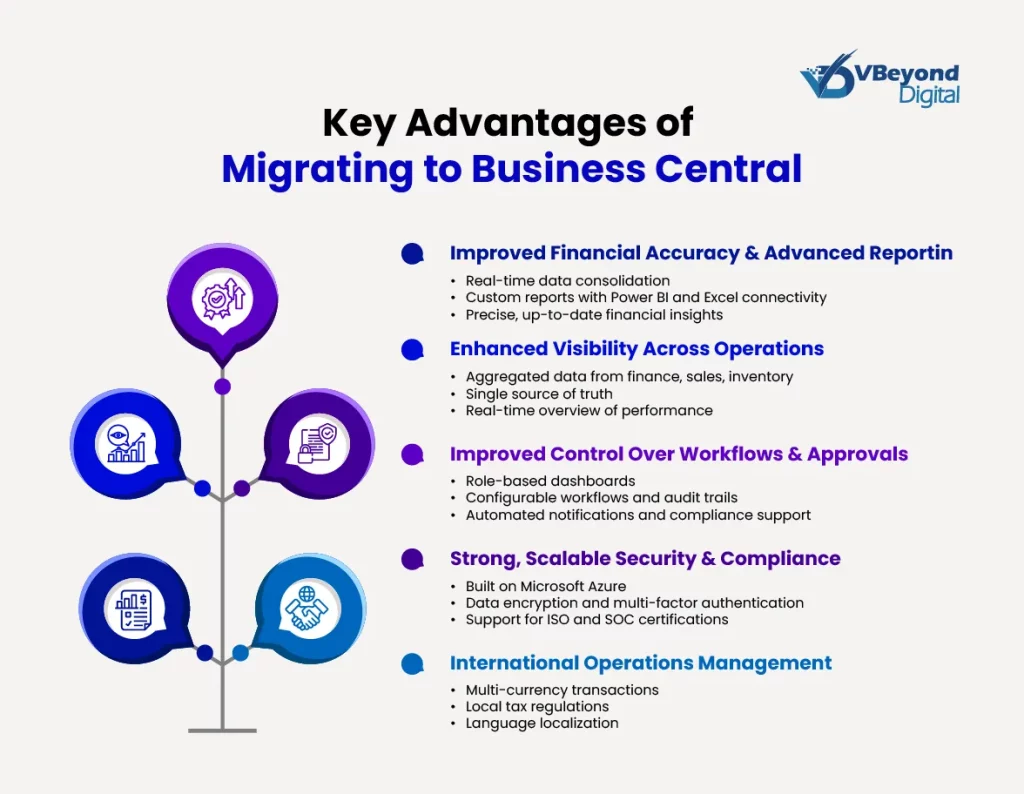

Key Advantages of Migrating to Business Central

A move from QuickBooks to Business Central offers several technical benefits that directly address the limitations of legacy accounting software. One key advantage of migrating from QuickBooks to Dynamics 365 Business Central migration is improved financial accuracy and advanced reporting. The Dynamics 365 Business Central system is engineered with rigorous financial controls and detailed reporting features that overcome QuickBooks limitations. The solution supports real-time data consolidation from various business modules, allowing decision makers to generate custom reports with the power of Power BI and Excel connectivity. This capability meets the need for QuickBooks advanced reporting, offering precise, up-to-date financial insights that help reduce discrepancies and support strategic planning.

Another important benefit of moving from QuickBooks to Business Central is the enhanced visibility across operations. The system aggregates data from finance, sales, inventory, and more into a single source of truth. Business Central integrations with Microsoft 365 and the Power Platform facilitate immediate access to operational metrics, which reduces manual intervention and data entry errors. This unified data view is critical for executives who require a reliable, real-time overview of performance across departments.

Business Central also delivers improved control over workflows and approvals. Its role-based dashboards and configurable workflows allow organizations to set up clear approval processes and track each transaction with an audit trail. Automated notifications and systematic record-keeping help maintain regulatory compliance and support operational consistency—features that are often missing in basic accounting software.

In addition, the benefits of Business Central extend to strong, scalable security and compliance features. Built on Microsoft Azure, the system incorporates advanced security protocols such as data encryption and multi-factor authentication, along with support for industry standards like ISO and SOC certifications. These security features are essential when migrating sensitive financial data from QuickBooks to Business Central.

Furthermore, the ability to manage international operations is a significant advantage for companies planning a QuickBooks to Business Central transition. The solution supports multi-currency transactions, local tax regulations, and language localization, making it easier to manage financial operations across different legal entities and geographic regions.

QuickBooks to Dynamics 365 Migration Process: Step-by-Step

The migration from QuickBooks to Business Central involves a structured, multi-phase process designed to transfer data accurately and minimize business disruption. This section outlines each step based on guidance available on Microsoft’s official resources.

Pre-Migration Planning

Begin by reviewing your current QuickBooks setup to identify critical financial and operational data. Key actions include:

- Data Assessment and Cleaning: Audit existing records in QuickBooks to identify duplicate or outdated information. Document QuickBooks limitations and areas where QuickBooks advanced reporting falls short, ensuring you know which datasets are essential for a QuickBooks to Dynamics 365 migration.

- Mapping and Roadmap Development: Define which data points—such as customer, vendor, and transaction records—must be migrated. Create a migration roadmap that outlines the timeline and resources required. Microsoft recommends that organizations detail their data architecture before transitioning to the Dynamics 365 Business Central system.

Exporting Data from QuickBooks

Extract data from QuickBooks in a format compatible with Business Central. During this step:

- Data Extraction: Export customer, vendor, financial, and transaction records. Pay close attention to historical accuracy, as even minor discrepancies can compound over time.

- Validation: Verify the exported data against QuickBooks reports to address any inconsistencies due to QuickBooks limitations.

Importing Data into Business Central

After cleaning and exporting the necessary data, begin the import process:

- Data Mapping: Map the exported fields from QuickBooks to the corresponding fields in Business Central. Microsoft provides migration templates that help address differences in data structure when moving to the Dynamics 365 Business Central system.

- Automated Tools: Use available migration tools to facilitate a QuickBooks to Dynamics 365 migration. These tools help convert and load data, reducing manual intervention and the risk of errors.

- Business Central Integrations: Ensure that any integrations with external systems—such as banking feeds or inventory management solutions—are configured in Business Central to maintain continuity.

Testing and Verification

Before a full rollout, conduct extensive testing:

- Test Migrations: Run a series of test imports in a non-production environment. Verify that data transfers correctly and that the QuickBooks advanced reporting capabilities of Business Central produce accurate financial reports.

- Data Integrity Checks: Compare sample reports from QuickBooks with those generated by Business Central. This step confirms that the benefits of Business Central, such as improved accuracy and real-time insights, are realized.

Training and Adoption

Finally, prepare your team for the new system:

- User Training: Provide training sessions for key personnel on the new workflows within Business Central. Microsoft Learn offers detailed training modules on configuring and using Business Central.

- Change Management: Address any resistance or challenges by clearly communicating the advantages of a QuickBooks to Business Central migration. Focus on how Business Central integrations with Microsoft 365 and Power BI support improved financial control and reporting.

Common Migration Challenges and How to Overcome Them

When moving from QuickBooks to Business Central, organizations often face several technical challenges. One primary issue is data mismatches. QuickBooks limitations in handling complex datasets can result in discrepancies when exporting data. This may lead to incomplete or inconsistent financial records during a QuickBooks to Dynamics 365 migration. To address this, companies should perform detailed data cleansing and mapping during the pre-migration planning stage.

Another challenge is user adoption. Finance teams accustomed to QuickBooks may experience difficulties adjusting to new processes in the Dynamics 365 Business Central system. Providing targeted training and clear documentation can help alleviate resistance and smooth the transition to QuickBooks to Business Central operations.

Unexpected costs and project overruns can also occur if the migration plan is not thoroughly defined. A careful review of requirements and a phased approach to the migration process reduce risks and help manage project budgets effectively.

Finally, integrating the new ERP with existing business tools is critical. Business Central integrations with Microsoft 365, Power BI, and other applications play a vital role in maintaining a continuous flow of information. Addressing integration challenges by using certified migration tools and following Microsoft guidelines can minimize data silos and support the benefits of Business Central.

Expected Business Impact After Migration

Adopting the Dynamics 365 Business Central system after a QuickBooks to Dynamics 365 migration can bring significant operational benefits. Organizations have confirmed that this enables faster financial reporting and quicker decision-making because the system consolidates data from various departments—finance, sales, inventory, and operations—into real-time dashboards. This improved reporting capability addresses QuickBooks limitations and provides QuickBooks’ advanced reporting features that support detailed financial analysis.

The Dynamics 365 Business Central overview on Microsoft’s website details how the system’s role-based dashboards and user interfaces facilitate better collaboration among departments. By centralizing critical data, the system enables executives to obtain a unified view of business performance. This improves accountability and reduces the time spent reconciling disparate data sources that are common with traditional accounting software.

Another impact is seen in the strengthened audit trails and compliance tracking. The robust audit functionality in Business Central tracks every transaction, offering a clear trail for regulatory reviews and internal audits. This is particularly valuable for companies that have experienced QuickBooks to Business Central challenges in maintaining strict compliance and security standards.

Additionally, the scalability of the Business Central integrations with other Microsoft products, such as Microsoft 365 and Power BI, supports growing operations. Organizations moving from QuickBooks benefit from an ERP solution that not only manages increased transaction volumes but also adapts to multiple business units and multi-currency environments. These benefits of Business Central result in improved operational efficiency and better resource management, ultimately supporting sustained growth.

Conclusion

A move from QuickBooks to Dynamics 365 Business Central system is a strong technical upgrade for organizations facing QuickBooks limitations. The detailed process for a QuickBooks to Dynamics 365 migration—from thorough data assessment and cleaning to rigorous testing and user training—offers a clear, methodical path for addressing the shortcomings of traditional accounting software. This approach allows companies to overcome issues such as data discrepancies and the absence of QuickBooks’ advanced reporting features.

By adopting the Dynamics 365 Business Central system, organizations benefit from robust Business Central integrations with other Microsoft applications. This consolidation of finance, operations, and customer data provides high-level executives with a single source of truth, supporting better decision-making. The system’s role-based dashboards, real-time analytics, and detailed reporting capabilities meet the demands of businesses that have outgrown QuickBooks, enabling improved financial accuracy and operational control.

FAQs

You can migrate essential data such as customers, vendors, items, chart of accounts, beginning balance transactions in the general ledger, on-hand inventory quantities, and open customer and vendor documents like invoices and payments.

The duration varies based on business size and complexity. Typically, migrating from QuickBooks to Dynamics 365 Business Central can take from a few weeks to several months.

Yes, Microsoft provides the QuickBooks Data Migration Extension, which helps import data from QuickBooks Desktop to Business Central. This extension guides you through exporting data from QuickBooks and importing it into Business Central.

Costs vary depending on factors like data volume, user count, customization needs, and professional services. It’s recommended to consult with a Microsoft partner or migration specialist for a tailored cost estimate.

Migrating offers several advantages, including advanced financial management, improved supply chain management, better business insights, seamless integration with other Microsoft tools, and enhanced scalability to support business growth.