Section

Securing Retail Transactions with Dynamics 365 and Azure Security Features

Section

Table of Contents

- Dynamics 365 and Azure: Building a Unified Security Strategy

- Architecting a Secure Environment with Dynamics 365

- Deploying Azure for Enhanced Security Measures

- Advanced Security Features for Transaction Protection

- Compliance Mastery with Dynamics 365 and Azure

- Industry Case Study: How Firms Have Transformed Financial Security

- Conclusion: Building a Resilient Financial Services Stack Conclusion

Section

As digital threats multiply, securing retail transactions is crucial for sustaining consumer confidence and business credibility. This blog examines how Dynamics 365 and Azure deliver essential retail security solutions through state-of-the-art security features. With Dynamics 365 Fraud Protection and Azure’s security management tools, retailers can build strong defenses against cyber threats and fraudulent activities. Explore how employing these robust technologies ensures transaction security and reinforces data protection for retailers.

Integrating security solutions into core operations for retail financial services firms enables a stronger security posture against a backdrop of increasing digital payment solutions, ensuring that both digital and offline transactions are secure from threats. This approach not only mitigates risk, but also fortifies the financial institution’s reputation as a trusted entity. The key elements of this approach include:

- Advanced Threat Protection: Financial institutions are under constant attack from cybercriminals employing sophisticated techniques to infiltrate networks and exfiltrate data. This reality demands security solutions that are both resilient and adaptive, using cutting-edge technologies such as artificial intelligence and machine learning for real-time threat detection and response.

- Regulatory Compliance and Trust: Cybersecurity is not merely a technical requirement but a strategic component essential for maintaining compliance with global regulatory standards and sustaining customer trust. Dynamics 365 fraud protection and Azure security tools ensure that financial institutions can meet these standards through rigorous data protection measures and identity management systems.

Dynamics 365 and Azure: Building a Unified Security Strategy

Dynamics 365 and Azure provide a powerful, scalable framework for data security and regulatory compliance within financial institutions. This unified strategy uses the comprehensive capabilities of both platforms to create a fortified environment for retail transactions across digital and physical domains.

Key focused features are –

- Comprehensive Security Architecture: Dynamics 365 integrates seamlessly with Azure’s extensive security infrastructure, providing a layered security model that includes data encryption, identity management, and threat detection.

- Strategic Alignment with Security Needs: The combined capabilities of Dynamics 365 and Azure are designed to meet the complex security demands of banks, payment service providers, and intermediaries, ensuring that all facets of financial operations are protected.

Architecting a Secure Environment with Dynamics 365

Dynamics 365’s security architecture is meticulously designed to safeguard financial transactions by integrating advanced security technologies and best practices. This section explores the core components of Dynamics 365’s security framework, which ensures that sensitive financial data remains protected across all retail operations.

Core Components –

- Role-Based Access Control and Data Encryption: Dynamics 365 enhances security through granular access controls and robust data encryption methodologies. Role-based access ensures that only authorized personnel have access to sensitive information, minimizing the risk of data breaches.

- Secure Data Management: Utilizing Microsoft Entra ID for identity management, Dynamics 365 strengthens the security posture of financial institutions by ensuring that only authenticated users can access the system, thereby enhancing retail data protection.

Deploying Azure for Enhanced Security Measures

Deploying Azure for Enhanced Security Measures

Azure’s security infrastructure plays a pivotal role in complementing Dynamics 365’s capabilities, providing a comprehensive and robust framework that secures critical financial operations. This section delves into how Azure fortifies the security environment for financial institutions using Dynamics 365.

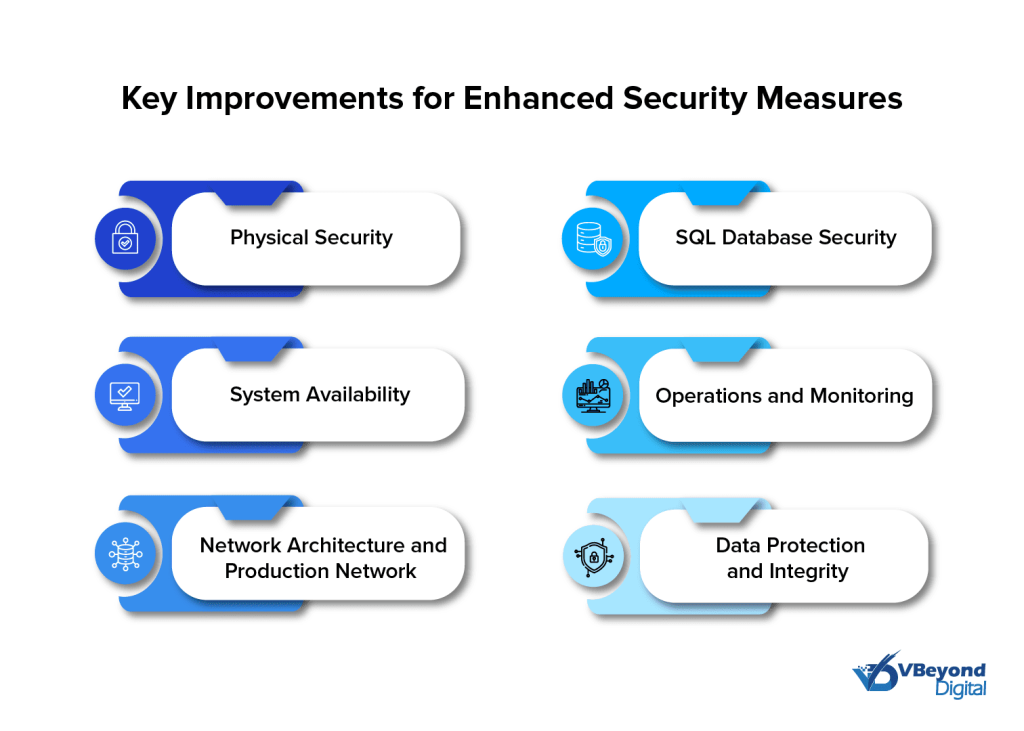

Key improvements as a result of this deployment include:

- Physical Security: Azure implements rigorous physical security measures at its data centers, including biometric scanning, motion sensors, 24/7 secured access, and video surveillance to prevent unauthorized physical access.

- System Availability: Azure ensures high availability with redundancy strategies, failover protocols, and disaster recovery capabilities to maintain service continuity under all circumstances.

- Network Architecture and Production Network: The architecture of Azure’s network is designed to maximize security and operational efficiency. It includes segmented networks and controlled network access that safeguards against external breaches.

- SQL Database Security: Azure SQL Database employs a layered security model that includes encryption, auditing, and threat detection features to secure data against unauthorized access and threats.

- Operations and Monitoring: Continuous monitoring and regular operational assessments are conducted to ensure the integrity and performance of security systems. Azure uses advanced threat analytics and security information event management to detect and respond to potential security incidents promptly.

- Data Protection and Integrity: Azure emphasizes data protection through encryption-at-rest and in-transit, along with comprehensive data governance practices that ensure data integrity and security.

Advanced Security Features for Transaction Protection

Dynamics 365 and Azure offer many advanced security features designed to protect both digital and offline retail transactions. This ensures that all aspects of financial transactions are safeguarded against potential security threats.

Advanced Security Measures:

- Multi-Factor Authentication and Conditional Access: These features provide an additional layer of security by requiring multiple forms of verification before access is granted, significantly reducing the risk of unauthorized access.

- Threat Management: Dynamics 365 and Azure continuously monitor for suspicious activities, using advanced algorithms to detect and respond to potential threats in real-time.

Additionally, Azure ExpressRoute offers private connections to Azure services, further enhancing the security of sensitive financial data by bypassing public internet routes and reducing exposure to potential cyber-attacks.

These security features are integral in maintaining a secure environment for financial transactions, ensuring that retail businesses can operate with confidence, knowing their data and customer information are well-protected.

Section

Section

Secure your financial operations today

Compliance Mastery with Dynamics 365 and Azure

Dynamics 365 and Azure not only enhance security but also simplify compliance with global financial regulations. This integration is critical in helping financial institutions meet compliance standards such as GDPR (General Data Protection Regulation), PCI-DSS, and others.

Compliance Features:

- Comprehensive Compliance Portfolio: Microsoft maintains a vast array of compliance offerings across different regions and industries, which includes everything from formal certifications to self-assessments and guidance documents. This broad coverage helps organizations adhere to various legal and regulatory standards globally.

- Assurance Programs: Both Dynamics 365 and Azure are involved in assurance programs like ISO 27001, SOC 1, SOC 2, and GDPR, among others. These certifications are crucial for ensuring that services meet stringent security and compliance standards, which is vital for financial institutions.

- Regulatory Compliance Tools: Tools like Microsoft Purview Compliance Manager help organizations manage their compliance posture by offering risk-based score measurements and recommendations based on regulatory standards. This tool is particularly useful in simplifying the complexities associated with implementing and managing compliance controls.

- Data Management and Security: Compliance also extends to data management, with both platforms providing capabilities that ensure data is stored and managed according to the specific regulations of different countries, such as data residency and data sovereignty requirements.

- Customized Compliance Support: Microsoft Cloud for Financial Services offers tailored compliance support, which includes engaging with Microsoft’s experts to address compliance concerns, risk and control mapping, and access to a compliance community for sharing best practices.

Industry Case Study: How Firms Have Transformed Financial Security

The implementation of Dynamics 365 and Azure has dramatically transformed the security landscape for many financial institutions. This section highlights real-world examples of banks and payment service providers that have successfully leveraged these platforms to enhance their security measures.

Investec (Banking and Capital Markets)

Background and Challenges: Investec, a distinguished player in banking and capital markets, faced challenges in managing client relationships and operational efficiency due to disparate systems across its global operations. The primary challenge was to consolidate these systems to enhance client management and operational transparency.

Solution Implementation: Investec implemented Microsoft Dynamics 365 to unify its client management system. This strategic move aimed to consolidate various functions into a single platform, thus enabling seamless client engagement and streamlined backend operations.

Outcomes and Benefits:

- Enhanced Client Engagement: Dynamics 365 provided a unified view of client activities, improving the responsiveness and personalization of client interactions.

- Operational Efficiency: The integration reduced redundancies and improved process efficiency, leading to cost savings and faster response times.

- Compliance and Reporting: Improved tracking and reporting mechanisms helped in better compliance management and operational reporting, crucial for financial institutions under stringent regulatory standards.

The Investec case study highlights how Dynamics 365 can be leveraged to enhance data integration and client management in a complex, regulated environment. More details can be found on the Microsoft Customer Stories page.

Navigating Future Security Challenges in Financial Services

The cybersecurity landscape in financial services is rapidly evolving due to several interconnected factors that pose significant challenges for the future. Here are some of the key insights and challenges identified:

- Expanding Digital Footprint: The increasing reliance on digital platforms amplifies existing risks and introduces new vulnerabilities. Financial services must manage risks associated with a broader digital footprint, including more endpoints and greater exposure to cyber threats.

- Adapting to Emerging Technologies: The integration of emerging technologies such as AI, machine learning, and blockchain introduces new complexities. These technologies can offer significant benefits but also bring new types of cyber risks that need to be carefully managed.

- Ransomware and Phishing Attacks: Financial institutions continue to be prime targets for ransomware and phishing attacks due to the lucrative nature of their operations. Attackers often exploit human error, such as through phishing emails or compromised credentials, making continuous education and sophisticated defense mechanisms essential.

- Regulatory Challenges: With the rapid pace of technological change, regulatory frameworks are also evolving. Financial services must navigate these changes to ensure compliance while also adapting security measures to protect against sophisticated cyber threats.

- Third-Party and Supply Chain Risks: Increased reliance on third-party vendors and IT suppliers adds another layer of complexity, requiring robust strategies for third-party risk management. This includes ensuring that all parties involved adhere to stringent security standards to protect sensitive data and systems.

- Zero Trust Architectures: Adopting Zero Trust principles, which assume that threats may exist both inside and outside traditional network boundaries, is becoming a best practice. This approach helps mitigate risks by enforcing strict access controls and continuously verifying the security status of all entities interacting with the network.

Conclusion: Building a Resilient Financial Services Stack

The strategic integration of Dynamics 365 and Azure has redefined cybersecurity in the financial services industry. This partnership not only secures financial transactions but also fortifies the entire financial ecosystem against a spectrum of cyber threats.

Recap of Key Points:

Robust Security Measures: Dynamics 365 and Azure deliver comprehensive security solutions that protect sensitive data and ensure the integrity of financial transactions across both digital and physical platforms.

Regulatory Compliance and Trust: These platforms help financial institutions meet stringent regulatory requirements and maintain customer trust by providing transparent and secure operations.

To remain competitive and secure in this digital age, it is crucial for senior executives in the financial sector to prioritize cybersecurity. Leveraging cutting-edge technologies like Dynamics 365 and Azure not only mitigates risks but also ensures a proactive stance against future security challenges, thereby supporting sustained business growth and customer satisfaction.