Section

Role-Based Power BI Dashboards for Enhanced Decision Making

Section

Table of Contents

- Strategic Importance of Role-Based Access in Financial Data Management

- Designing Focused Dashboards for Senior Executives

- Advanced Security Features for Protecting Sensitive Information

- Deploying AI and Machine Learning in Dashboards

- Best Practices for Maintaining and Scaling Role-Based Dashboards

- Future Trends in Data Visualization for Executive Leadership

- Conclusion: The Strategic Advantages of Tailoring Power BI Dashboards for Senior Executives

Section

This blog explores the significant benefits of role-based Power BI dashboards, specifically tailored for senior executives in the financial sector. It delves into how customized access to critical data not only maintains data security but also aligns with financial regulations, supporting precise and secure decision-making processes. Through real-world case studies, the blog demonstrates the transformative impacts these dashboards have on operational efficiency, risk management, and strategic planning. Additionally, it highlights the advanced security measures essential for protecting sensitive information and discusses the future of executive decision-making with emerging technologies. The blog ultimately provides practical guidelines for maintaining and scaling these dashboards to meet evolving business needs.

Power BI, a dynamic business intelligence and analytics tool, has become an important solution for high-level decision-making. It provides an intuitive platform for visualizing vast arrays of data, facilitating better strategic decisions. For financial management and decisions, Power BI financial dashboards play a pivotal role. These dashboards offer personalized views that are crucial for executives, particularly CFOs, who require quick access to essential financial metrics.

What are Role-Based Dashboards on Power BI

Role-based dashboards streamline periodic performance reviews for decision-makers by giving them real-time access to the data most relevant to their roles. Here’s how these dashboards transform strategic insights and streamline operations:

- Customization and Flexibility: Power BI allows for the customization of dashboards that align with the specific informational needs of different executive roles, such as Head of Sales, CFOs, or CEOs. This means that a CFO dashboard in Power BI can be specifically designed to highlight financial health indicators like cash flow, profitability, and revenue streams.

- Security and Control: Role-based access ensures that sensitive information remains secure yet is readily accessible to authorized users. This not only protects the data but also complies with stringent regulatory requirements.

- Strategic Alignment: These dashboards provide a cohesive view of the organization’s financial status, aligning various departments and facilitating unified decision-making that supports the company’s overall strategic goals.

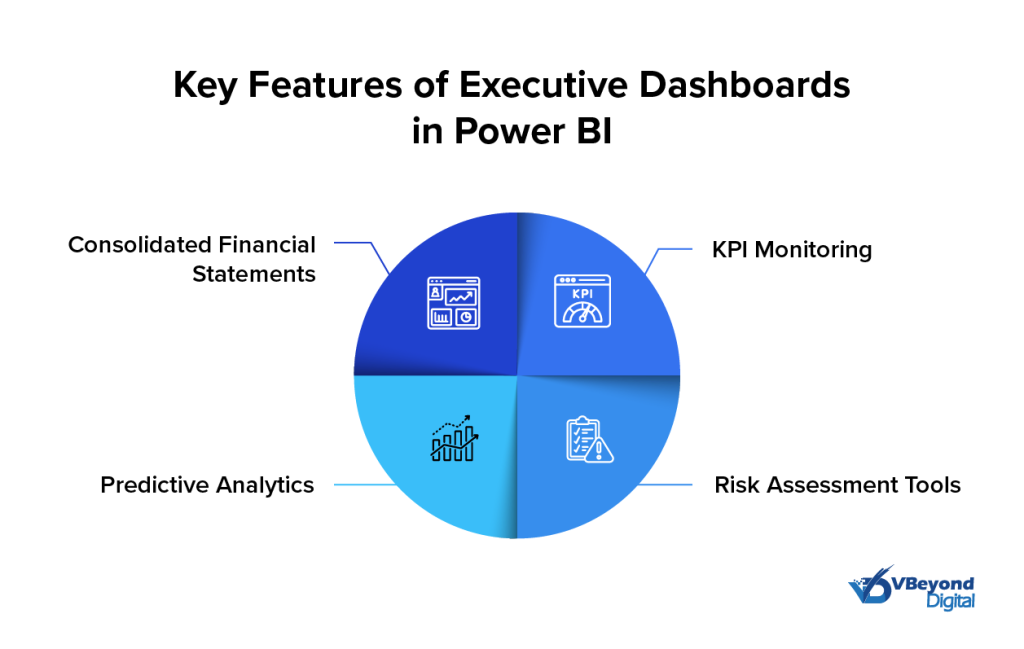

Key Features of Executive Dashboards in Power BI

- Consolidated Financial Statements: Quick overview of the company’s financial performance.

- KPI Monitoring: Real-time tracking of key performance indicators to gauge financial health.

- Risk Assessment Tools: Visual tools to assess and mitigate financial risks.

- Predictive Analytics: Utilization of AI algorithms to forecast future trends based on historical data.

Strategic Importance of Role-Based Access in Financial Data Management

Role-Based Access Control (RBAC) is a critical component in the management of financial data within organizations. By implementing RBAC, businesses ensure that sensitive information is accessible only to authorized personnel, thereby ensuring security and compliance with financial regulations.

Maintaining Data Integrity and Security

Data integrity and security are paramount in financial environments where the impact of unauthorized access or data breaches can be catastrophic. Role-based access helps in mitigating these risks by:

- Defining Clear Access Levels: Each role within the organization has specific access rights, minimizing the risk of sensitive information being exposed to unauthorized users.

- Audit Trails: RBAC systems keep detailed logs of who accessed what information and when, which is crucial for compliance audits and forensic analysis.

Compliance with Financial Regulations

Financial institutions are governed by numerous regulations such as GDPR, SOX, and HIPAA, which mandate stringent data protection standards. Role-based access facilitates compliance by:

- Automating Compliance Processes: Automating the enforcement of access policies ensures that compliance is continuous and not reliant on manual processes.

- Minimizing Human Error: By restricting access to sensitive data based on user roles, RBAC reduces the chances of human error, a common cause of data breaches.

Enhancing Data-Driven Decision Making

Role-based access extends beyond security and compliance to play a strategic role in enhancing data-driven decision-making. By tailoring access according to the user’s role, organizations can:

- Streamline Data Flow: Ensuring that employees have access only to the data necessary for their roles reduces complexity and enhances focus.

- Improve Response Times: Quick access to relevant data allows decision-makers to react swiftly to market changes, leveraging real-time insights generated from Power BI financial dashboards.

Advanced Security Features for Protecting Sensitive Information

In today’s digitalization, safeguarding sensitive financial information is paramount. Power BI provides advanced security features that are critical for protecting data within financial sector dashboards. These features not only ensure data security but also foster trust by adhering to regulatory requirements.

Data Encryption and Sensitivity Labels

Power BI enhances security through comprehensive data encryption both at rest and in transit, ensuring that all data within the Power BI financial dashboard is shielded from unauthorized access.

- At Rest: Data stored in databases is encrypted using industry-standard protocols.

- In Transit: Data exchanged over networks is protected using strong encryption methods, such as TLS (Transport Layer Security).

Moreover, Power BI allows for the application of sensitivity labels to dashboards and reports. These labels help in:

- Classifying Data: Marking data according to its sensitivity level, which dictates how it should be handled and who can access it.

- Regulatory Compliance: Ensuring that data handling procedures meet strict regulatory standards, critical in the financial sector.

Integration with Azure Active Directory

Integration with Azure Active Directory (Azure AD) provides robust identity and access management solutions, crucial for implementing role-based access controls (RBAC). This feature enhances the security of Power BI executive dashboards by:

- Authentication and Authorization: Azure AD manages user authentication and authorization, ensuring that only authenticated and authorized users can access sensitive information.

- Multi-Factor Authentication (MFA): Azure AD supports MFA, an essential security feature that requires users to provide multiple forms of identification before accessing sensitive data.

Multi-Factor Authentication (MFA)

Implementing MFA is another layer of security that significantly reduces the risk of unauthorized access to the CFO dashboard in Power BI. MFA requires users to verify their identity using more than one method of authentication, such as:

- Something They Know: A password or PIN.

- Something They Have: A smartphone app to approve authentication requests.

- Something They Are: Biometrics, like a fingerprint or facial recognition.

Deploying AI and Machine Learning in Dashboards

The integration of AI and machine learning within Power BI dashboards offers transformative capabilities for senior executives, enabling them to predict trends and automate insights. These technologies help in refining strategies and making informed decisions based on advanced data analytics.

Predictive Analytics and Trend Prediction

AI and machine learning algorithms analyze historical data to forecast future trends. In the context of a Power BI financial dashboard, this can mean predicting market fluctuations, customer behavior, and financial outcomes. These predictions allow executives to proactively adjust strategies and improve decision-making accuracy.

- Forecasting Financial Metrics: AI models can predict future revenue, expenses, and profitability based on past performance and current trends.

- Risk Assessment: Machine learning helps in identifying potential financial risks by analyzing patterns that human analysts might overlook.

Automation of Insights

Automating insights through AI reduces the need for manual data analysis, speeding up the decision-making process. In Power BI AI dashboards, this automation can take several forms:

- Anomaly Detection: AI algorithms automatically detect anomalies in financial data, alerting executives to potential issues before they escalate.

- Performance Indicators: Machine learning models identify key performance indicators (KPIs) that are most impactful for the business, allowing for more focused analytics.

Real-Time Decision Making

The real-time processing capabilities of AI in Power BI enable executives to make decisions based on the most current data available. This is particularly crucial in fast-paced sectors like finance, where market conditions can change rapidly.

- Market Trends: AI models integrate real-time market data to provide up-to-date insights, allowing executives to make informed investment decisions swiftly.

- Operational Adjustments: Real-time data analysis helps in making immediate operational adjustments, enhancing efficiency and responsiveness.

Section

Section

Boost Strategic Insights with Power BI

Best Practices for Maintaining and Scaling Role-Based Dashboards

As organizations grow and their strategic priorities evolve, maintaining and scaling role-based Power BI dashboards becomes crucial. Ensuring that these dashboards remain effective, compliant, and aligned with business needs requires continuous management and refinement.

Regular Updates and Audits

- Continual Improvement: Technology and business environments are dynamic; therefore, dashboards must be regularly updated to reflect new data sources, business processes, and analytics needs.

- Data Accuracy: Regularly verify data sources for accuracy and relevancy, ensuring that the information displayed is both current and correct.

- Audit Trails: Maintain logs of dashboard access and changes to track usage patterns and modifications, crucial for compliance and security assessments.

Scaling Role-Based Access Controls

As organizations expand, the complexity of data access management can increase. Scaling role-based access controls efficiently is vital to secure data management.

- Automated Role Management: Implement automated systems to manage role assignments and access rights, especially in large organizations where manual management is impractical.

- Dynamic Access Control: Adapt access controls based on contextual factors such as user location, device security status, and current organizational roles.

Ensuring Continued Compliance and Relevance

- Regulatory Compliance: Financial institutions must adhere to a myriad of regulations that dictate how data should be managed and protected.

- Compliance Updates: Regularly update the dashboard configurations to comply with new or amended regulations.

- Role Review: Periodically review user roles and access rights to ensure they align with current regulatory and corporate governance standards.

Future Trends in Data Visualization for Executive Leadership

As technology advances, the tools and techniques available for data visualization are rapidly evolving. Emerging trends in data visualization, such as augmented reality (AR) and virtual reality (VR), are poised to dramatically transform how executive leadership interacts with and interprets complex data sets.

Augmented Reality (AR) and Virtual Reality (VR) in Dashboards

AR and VR technologies offer immersive ways to interact with data, providing a three-dimensional perspective that can enhance understanding and engagement.

- Immersive Data Interaction: AR and VR enable executives to step into a virtual space where data can be manipulated and explored from all angles, offering a deeper understanding of complex metrics and trends.

- Enhanced Collaboration: These technologies can facilitate collaborative sessions where remote teams can interact with the same data set in real-time, despite geographical separations.

Industry Examples Where AR/VR are Applied

- Logistics: The logistics industry has pioneered the use of AR and VR for creating digital twin models of warehouse operations and enhancing robotic process information. This application helps in improving customer service and simplifying delivery processes (Linde).

- Biotechnology, Aerospace, and Finance: These sectors are actively integrating VR/AR into their operations. Biotech labs use VR to simulate molecular interactions for a better understanding of complex biological processes. Aerospace engineers utilize AR for overlaying data on physical models of aircraft to aid in design and testing. In finance, VR is employed to visualize market trends and economic models, making it easier for analysts to identify patterns and correlations (Mersus Technologies).

- Retail and Customer Experience: Companies in the retail sector are using AR and VR to enhance customer experiences. For example, some hotels and resorts allow customers to virtually visit rooms before booking, which has increased engagement and boosted reservations. Additionally, AR is used to provide tourists with virtual guides and relevant local information, enhancing travel experiences (Computools) (Modern Retail)

Preparing for the Future

To capitalize on these emerging technologies, organizations should consider the following strategies:

- Infrastructure Readiness: Ensure that the IT infrastructure can support AR and VR technologies in processing power and data handling capabilities.

- Skill Development: Invest in training programs for technical staff and executives to familiarize them with the new tools and their potential applications in business analytics.

Adopting these advanced visualization tools requires visionary leadership willing to embrace new technologies and drive innovation. By integrating AR and VR into Power BI dashboards, organizations can not only enhance the visual representation of data but also improve the strategic decision-making process, making it more dynamic and responsive to changes.

Conclusion: The Strategic Advantages of Tailoring Power BI Dashboards for Senior Executives

The strategic implementation of role-based Power BI dashboards for senior executives in the financial sector brings numerous benefits that can significantly enhance decision-making and operational efficiency. By customizing dashboards to meet the specific needs of high-level roles, organizations can ensure that their leaders have the tools necessary to drive success.

The future of executive decision-making strongly relies on the effective use of data visualization and business intelligence tools. Leaders are encouraged to:

- Invest in Technology: Prioritize the adoption of the latest innovations in data analytics and visualization to maintain a competitive edge.

- Foster a Data-Driven Culture: Cultivate an environment where data-driven decision-making is the norm, enhancing strategic initiatives across all levels of the organization.

Power BI dashboards built specifically for senior executives not only simplify complex data but also transform it into a strategic asset that can drive the financial sector forward. By leveraging these tools, organizations can ensure that their leaders are equipped to make proactive decisions that are both timely and informed by data.