Next-Level Customer Service Automation: Power Platform’s Role in Smarter CX for Financial Services

Section

Table of Contents

- Current Applications of Customer Service in Financial Institutions

- Power Platform Introduction and Capabilities

- Automating Customer Service with Power Platform

- Data Integration and Analytics for Improving Customer Service in Finance

- Reducing Costs and Improving Efficiency with Power Platform Automation

- Addressing Complex Customer Queries with AI and Human Interaction

- Implementation Challenges and Considerations for Financial Institutions

- Conclusion

Section

This blog focuses on the role of Microsoft Power Platform in advancing customer service automation within financial services. It covers how financial institutions can handle high volumes of requests efficiently while reducing operational costs. The discussion highlights the use of tools like Power Automate, Power Virtual Agents, and Power Apps to improve customer interactions, automate routine tasks, and support human agents in managing complex queries. Real-world examples illustrate how automation delivers timely service, reduces workloads, and aligns with modern customer expectations.

The demand for superior, multi-touchpoint customer service has become a significant challenge for financial services providers across. With clients expecting swift responses across multiple channels—mobile apps, websites, and social media platforms—traditional service models are struggling to keep pace. Institutions such as banks, financial intermediaries, and payment service providers are now grappling with the dual need for high-quality engagement and cost-effective operations.

To meet these requirements, customer service automation has become essential. This approach minimizes manual effort, reducing costs while addressing high-volume inquiries efficiently. Microsoft’s Power Platform plays a pivotal role in this transition. With tools like Power Automate, Power Apps, and Power Virtual Agents (now offered as a part of Microsoft Copilot Studio), financial institutions can build automated solutions that reduce response times, drive accuracy, and improve overall customer satisfaction.

Let’s dive into how Power Platform automation is changing customer service in finance and overcoming the operational challenges these institutions face.

Current Applications of Customer Service in Financial Institutions

The dynamics of customer service in financial institutions are changing rapidly due to digital innovations and the rising expectations of consumers. As highlighted in recent research, customers now expect more personalized, secure, and proactive engagement from their banks and financial providers. This heightened expectation drives organizations to focus on delivering fast, tailored solutions across multiple digital channels, including mobile apps and chat interfaces.

Key Developments:

1. Hyper-Personalization and AI

Financial institutions are increasingly implementing AI tools and data analytics to offer hyper-personalized services. AI not only predicts customer needs but also allows for individualized financial recommendations based on behavior, transaction history, and preferences. Hyper-personalization aims to create a customer experience that mirrors the seamless interactions found in retail and tech sectors.

2. Shift from Reactive to Proactive Service Models

Financial organizations are moving beyond reactive customer service by using predictive analytics. AI-powered insights help them engage proactively with customers—sending alerts on potential fraud, reminders for bill payments, and even customized offers that align with spending patterns. This shift is expected to reduce customer churn and enhance satisfaction.

3. Challenges Faced by Financial Institutions

- Integration Complexities: Many banks continue to struggle with integrating new automation technologies into legacy systems. This integration is critical for seamless customer service automation, yet it remains a significant hurdle.

- Compliance and Security Risks: With the increased use of digital channels, ensuring data privacy and regulatory compliance has become more complex, especially as customers demand both convenience and high-level security.

- Customer Trust and Data Transparency: Establishing trust through transparent data practices is now essential as customers express concerns about how their financial data is used across automated systems.

4. Increased Use of Self-Service Tools

Banks are adopting self-service portals, chatbots, and AI-driven interfaces to meet customer demands for faster and 24/7 assistance. However, balancing automation with the need for human interaction is crucial, as studies show that customers still prefer personal engagement for complex financial matters.

5. Cloud Adoption and Digital Infrastructure Expansion

Financial institutions are increasingly adopting cloud solutions to power automation and improve data handling. However, these transitions need to be carefully managed to avoid operational disruptions while ensuring compliance with evolving regulations.

Section

Section

Transform customer service with Power Platform.

Power Platform Introduction and Capabilities

Microsoft Power Platform is a suite of low-code tools designed to help businesses, including financial institutions, automate processes, build applications, and generate insights without needing extensive coding. This platform consists of four core components: Power Automate, Power Apps, Power Virtual Agents, and Power BI, each with distinct capabilities to support customer service automation and operational efficiency.

- Power Automate: This component allows businesses to automate repetitive tasks and create workflows across various systems. In financial institutions, Power Automate can manage case routing, notifications, and approval workflows, reducing the reliance on manual processes while improving response times.

- Power Apps: Power Apps empowers both professional developers and non-technical staff to build custom applications that connect to multiple data sources. Banks, for example, use Power Apps to develop tools for real-time customer engagement, streamlining operations like loan processing or client onboarding by consolidating data from CRM and other internal systems.

- Power Virtual Agents: These tools facilitate the creation of chatbots that interact with customers in real time, providing automated responses to queries about account balances, transactions, or general banking services. Financial organizations utilize these bots to reduce call center loads and address routine customer inquiries effectively.

- Power BI: Power BI offers robust data analytics, enabling institutions to visualize customer data and extract actionable insights. This capability is critical for tracking customer service performance and identifying trends that impact client satisfaction.

Automating Customer Service with Power Platform

Financial institutions rely heavily on customer service automation to manage operations efficiently. Power Platform tools—Power Automate, Power Virtual Agents, and Power Apps—offer robust solutions to automate repetitive processes, allowing service teams to focus on higher-value tasks.

Power Automate for Customer Service in Finance

- Automates mundane tasks, such as account notifications and payment reminders, eliminating the need for manual input.

- With automated workflows, banks can improve response times and keep customers informed, avoiding frustration and manual follow-ups.

Power Virtual Agents (Copilot Studio) for Real-Time Customer Interaction

- AI chatbots built using Power Virtual Agents handle inquiries across multiple channels, reducing call center dependency.

- The integration of virtual agents ensures smooth handoffs to human agents when inquiries require further intervention, maintaining service quality.

Power Apps for Tailored Customer Solutions

- Power Apps enables financial institutions to build custom solutions tailored to their unique workflows without heavy IT involvement.

Data Integration and Analytics for Improving Customer Service in Finance

Financial institutions generate massive amounts of customer interaction data across various channels such as web portals, call centers, and mobile apps. However, much of this data remains underutilized without integration and analytics tools that convert raw information into actionable insights. Power Platform automation plays a pivotal role in consolidating data from multiple systems, providing real-time analytics, and enhancing customer service in finance.

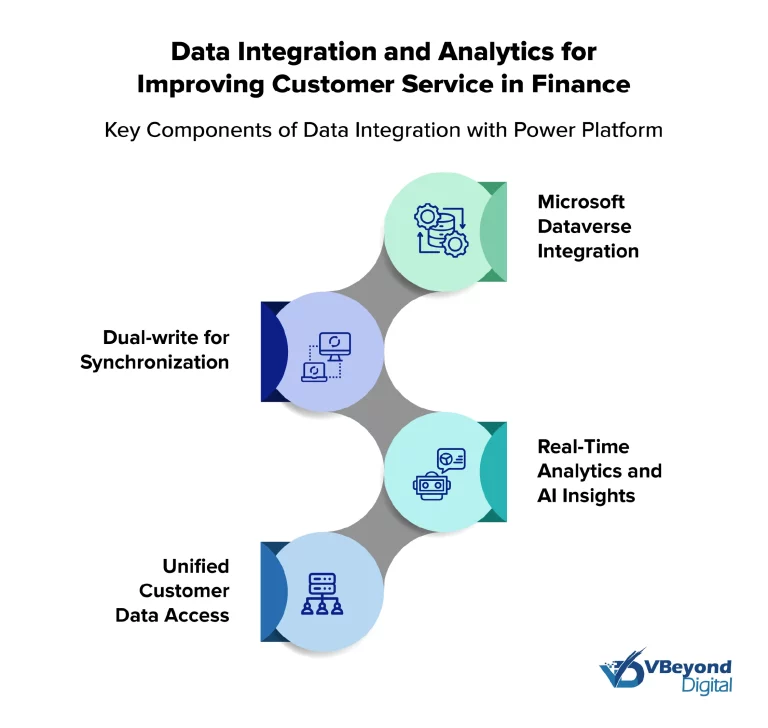

Key Components of Data Integration with Power Platform

- Microsoft Dataverse Integration: The Power Platform supports seamless integration with Dataverse, enabling financial institutions to centralize data from various touchpoints such as Dynamics 365 applications, CRM, and ERP systems. Through this setup, customer data becomes readily available across departments, facilitating faster resolutions and a unified customer experience. Institutions can also use pre-built templates to map data fields and establish consistent data flows between applications and databases.

- Dual-write for Synchronization: Dual-write functionality allows real-time synchronization between Dynamics 365 Finance and Power Platform. This capability ensures that customer data and case details remain consistent across front-end support teams and back-office systems, eliminating manual data entry errors. This integration allows finance teams to monitor customer interactions in real time and respond proactively.

- Real-Time Analytics and AI Insights: Power Platform enables finance teams to analyze trends and performance metrics through Power BI dashboards. AI tools can sift through vast datasets to identify customer behavior patterns, allowing financial institutions to predict potential issues or service disruptions. With this data, organizations can make informed decisions to prevent customer complaints and improve engagement through predictive analysis.

- Unified Customer Data Access: By integrating Power Platform with Microsoft Dataverse, financial institutions gain access to unified customer profiles. This comprehensive view empowers service agents with the right information during every interaction, improving the quality and relevance of their responses. Teams can also set up automated workflows that alert them about customer inquiries requiring immediate attention, streamlining case management across departments.

Reducing Costs and Improving Efficiency with Power Platform Automation

Financial institutions benefit from customer service automation by cutting operational expenses while maintaining high-quality interactions. Automating routine tasks with Power Platform reduces the need for human intervention, enabling service teams to focus on complex requests that require personal attention.

How Power Platform Automation Reduces Operational Costs

- Cost Efficiency Through Automation

The Power Platform offers significant cost savings by reducing the need for traditional software development and streamlining processes across financial institutions. A Forrester study highlights that organizations implementing Power Platform have reported a return on investment (ROI) of 502%, with savings from reduced development efforts and the elimination of outdated systems. Low-code solutions, like Power Apps, reduce dependency on external consultants, allowing non-developers to build essential tools internally, thus minimizing operational costs.

- Automation in Action: Real-World Impact

Financial institutions adopting Power Automate and Power Virtual Agents have minimized manual work in areas like compliance reporting and case management. For instance, automating employee verification requests using a chatbot built on Power Virtual Agents resulted in the elimination of 300,000 hours of manual work annually in one organization, greatly reducing human resource costs. In another example, a bank leveraged Power Automate to trigger instant notifications and approvals, cutting down processing times by over 30%.

- Optimizing Operational Workflows

Organizations integrating Power Platform components into their customer service automation can avoid the complexities of legacy systems. With pre-built connectors to systems like Microsoft Dynamics 365 and Teams, workflows become more responsive, reducing downtime and errors. The platform’s ability to centralize data also accelerates reporting and decision-making, ensuring consistent service delivery without additional labor.

- Time Savings and Resource Management

By enabling citizen developers to create apps and automate workflows, the Power Platform reduces time-to-market for solutions. This is particularly beneficial for financial institutions dealing with high transaction volumes and regulatory changes. The combination of reduced manual efforts and automated processes allows financial service teams to meet operational demands while cutting costs by as much as 40% compared to traditional methods.

Shift from Reactive to Proactive Engagement

With AI-powered analytics, institutions can move from reacting to customer complaints to addressing concerns before they arise. Predictive models built into Power Platform integration allow service teams to anticipate customer needs based on transactional behavior.

Case Example: An insurance firm integrated Power Virtual Agents with their CRM and reduced follow-up requests by 25%, thanks to proactive notifications about policy renewals.

Addressing Complex Customer Queries with AI and Human Interaction

Customer service automation in financial institutions involves managing both straightforward and complex customer requests. While automation tools like chatbots and self-service portals efficiently address routine inquiries, managing intricate or high-stakes issues requires combining AI capabilities with human expertise. This collaboration allows financial institutions to resolve complex queries effectively while maintaining the personalization that customers expect.

AI Support for Human Agents

AI plays a critical role in assisting customer service agents by automating repetitive tasks and providing quick access to essential information. For example, Microsoft Copilot integrates with Microsoft Teams and Dynamics 365 to generate case summaries, highlight key customer interactions, and recommend actions based on historical data. This reduces the need for agents to manually gather context, enabling faster resolutions with minimal effort. Such AI-augmented tools empower service agents to handle complex queries more efficiently, improving response quality and speed.

Conversational AI platforms, such as those provided by Aisera, further automate workflows by handling preliminary customer interactions. These tools employ natural language understanding (NLU) to identify user intent and create workflows that can resolve common issues or collect relevant information for handoff to a human agent if needed. Integrating this technology with Microsoft Teams ensures agents can seamlessly access data and transition between automated processes and manual intervention, enhancing service continuity and customer satisfaction.

Real-Time Collaboration Between AI and Human Agents

The role of AI in pre-qualifying queries ensures that human agents are only engaged when necessary. Power Virtual Agents, integrated with Dynamics 365, manage interactions such as FAQs, billing issues, or minor disputes autonomously. However, for cases requiring nuanced decision-making—such as resolving a billing dispute involving multiple departments—AI tools forward the relevant case history to human agents in real time. This transition reduces customer wait times and ensures that agents are equipped with relevant insights to resolve complex matters promptly.

Voice channel improvements in Dynamics 365 further facilitate complex interactions, offering enhanced features such as outbound dialing and IVR-based self-service options that route customers to the right department. AI systems mask sensitive data during these interactions, ensuring compliance and security without compromising service quality.

Case Study: Aisera’s Implementation with Microsoft Teams

Aisera’s integration with Microsoft Teams exemplifies how AI tools support complex service operations. By creating automated workflows and generating contextual responses, Aisera’s system helps resolve IT service requests and customer support issues swiftly. This hybrid approach—where AI manages initial interactions and human agents handle escalations—results in faster resolution times and higher customer satisfaction.

By balancing automation with human expertise, financial institutions improve efficiency while maintaining personalized service for high-impact queries. The collaborative use of AI and human interaction streamlines customer service operations, helping organizations reduce operational costs and improve customer loyalty through responsive, personalized service.

Implementation Challenges and Considerations for Financial Institutions

Deploying customer service automation through Power Platform automation in the financial sector presents several technical and operational challenges. Financial institutions must address these obstacles systematically to unlock efficiencies without compromising service quality, security, or compliance. Below is a detailed overview of the critical challenges faced by banks and financial service providers during implementation:

1. Legacy Systems and Data Integration Issues

Financial institutions often rely on a complex network of legacy systems, making integration a significant hurdle. Transitioning to Power Platform tools requires mapping existing databases and workflows to align with automated processes. Ensuring smooth Power Platform integration with core banking platforms and CRMs is essential to prevent data silos. Moreover, inconsistencies between legacy systems and newer interfaces can delay automation efforts.

Mitigation Strategy:

- Conduct phased integration, starting with non-critical workflows.

- Use middleware or API connectors to align disparate systems with Power Platform capabilities.

- Implement pilot projects to assess integration readiness before large-scale deployment.

2. Security and Regulatory Compliance

Given the sensitive nature of financial data, customer service in financial institutions must comply with strict regulatory standards, such as GDPR, PCI DSS, and local banking regulations. Automation systems must not only manage compliance but also ensure data protection during real-time operations. Unauthorized access or poor data management could lead to regulatory penalties.

Mitigation Strategy:

- Use Power Automate and Azure security features to enforce role-based access and multi-factor authentication.

- Integrate compliance checks directly within workflows to streamline reporting and audits.

- Employ Power Platform capabilities to automate routine compliance tasks, reducing the risk of human error.

3. Employee Skills Gap and Change Management

A shift to customer service automation involves training employees to use low-code tools such as Power Apps and Power Automate. Without adequate training, organizations risk underutilization of automation tools. Additionally, resistance to change among employees may slow adoption.

Mitigation Strategy:

- Offer hands-on training programs, focusing on real-world applications of Power Platform tools.

- Identify automation champions within departments to encourage broader acceptance.

- Build cross-functional teams to ensure that technical and non-technical staff collaborate effectively during the transition.

4. Scalability and Maintenance

Financial institutions handle vast customer bases and complex transactions, requiring automation systems to scale seamlessly. However, scaling automation without compromising performance or data integrity is a challenge, especially for high-volume services like loan processing and dispute management.

Mitigation Strategy:

- Use modular architecture to deploy Power Apps and workflows incrementally based on demand.

- Implement real-time monitoring through Power BI dashboards to ensure smooth operations during peak load.

- Regularly evaluate the automation environment to identify bottlenecks early.

5. Balancing Human Interaction with Automation

While customer service automation improves efficiency, fully replacing human interaction is not viable for complex queries. Financial services, such as mortgage applications or high-stakes fraud investigations, require a mix of automation and human expertise.

Mitigation Strategy:

- Use Power Virtual Agents to handle preliminary queries and seamlessly escalate unresolved issues to human agents.

- Equip customer service teams with AI-powered recommendations to assist in decision-making for complex cases.

- Automate routine tasks to free up human agents, allowing them to focus on personalized service.

Conclusion

Customer service automation through Power Platform automation offers financial institutions a practical solution to meet rising customer expectations while managing operational costs. Institutions benefit from improved customer engagement, faster response times, and reduced manual workloads.

The tools within Power Platform—Power Automate, Power Apps, and Power Virtual Agents—equip institutions to handle high volumes of customer requests, ensure consistent service, and focus on value-driven interactions. Automation helps shift from reactive service delivery to proactive engagement, with data-driven insights driving smarter decisions.

Financial leaders must view Power Platform integration not only as a cost-saving measure but as a strategy to maintain competitiveness and meet the demands of today’s customers. With the right automation tools, financial institutions can streamline operations, reduce expenses, and build stronger customer relationships.