Data Centers in the Crosshairs: Understanding Tariff Implications for Cloud Computing Expansion

Section

Table of Contents

- Hardware Bottlenecks and Semiconductor Supply Chain Risks

- Direct Impact on Data Center Construction Costs

- Economic and Investment Implications

- Supply Chain Disruptions and Component Availability

- Financial Implications for Cloud Service Providers

- Strategic Responses and Mitigation Efforts

- Broader Economic and Industry Implications

- Conclusion

- FAQs ( Frequently Asked Questions)

- Tariffs introduced: As of April 2025, the U.S. imposed a 10% baseline tariff on most imports, with rates as high as 125% on key goods from China, Taiwan (32%), and South Korea (25%).

- Cost impact: Data center construction costs have risen 8–12%, mainly due to higher prices on steel, aluminum, and critical electrical components.

- Operational risks: Supply chain delays and hardware shortages are slowing down cloud infrastructure builds and affecting project timelines.

- Next moves for leaders: Adjust budgets, diversify suppliers, and renegotiate contracts to manage rising costs and ensure project continuity. Building your cloud capabilities has never been more complex—or more costly. The tariffs that the U.S. government has announced look like they will add quite a lot of pressure to the physical infrastructure that powers cloud computing.

As of April 2025, the U.S. government has enacted a comprehensive tariff policy, affecting imports from various countries. A baseline tariff of 10% was imposed on nearly all imports starting April 5, 2025, under the International Emergency Economic Powers Act, aiming to address national trade imbalances (Source: The White House). Specifically, Chinese imports faced a significant increase, with tariffs rising to 125% on April 9, 2025, following escalating trade tensions and retaliatory measures from China (Sources: Reuters, New York Post). Taiwanese goods, excluding semiconductors, were subjected to a 32% tariff, prompting concerns and economic response measures from Taiwan’s government. Similarly, South Korean imports, particularly in the automotive and steel sectors, were hit with a 25% tariff, leading to emergency support initiatives by South Korea to mitigate the impact on its industries (Source: Reuters).

For CIOs, CTOs, and infrastructure leaders, the implications are immediate and material. Core inputs like steel and aluminum—used in structural builds and power frameworks—are now significantly more expensive. So are high-efficiency transformers, switchgear, and other power distribution units essential to running large-scale cloud infrastructure. These cost increases are already affecting data center construction budgets, delaying deployment timelines, and forcing recalculations of return on investment.

Recent reports show that major cloud providers such as Amazon, Microsoft, and Alphabet are significantly increasing their capital expenditures, primarily focusing on expanding data center capacity to support their artificial intelligence (AI) initiatives. For instance, Alphabet plans to invest approximately $75 billion in capital spending in 2025, emphasizing the development of chips and servers essential for core services like Google Search and AI platforms such as Gemini.

Similarly, Amazon has announced plans to spend over $100 billion on capital expenditure this year, with a sizable portion allocated to AI infrastructure. CEO Andy Jassy highlighted the necessity of substantial capital investment for AI chips and data centers, underlining the strategic importance of generative AI tools.

Microsoft is also intensifying its investments, with projected capital expenditures to the tune of $80 billion for its fiscal year ending in June, up 80% from the previous year. This surge in spending is largely directed toward building AI data centers to meet the growing demand for AI-driven services.

This article explores how the new tariffs are reshaping cloud infrastructure planning: from rising material costs and supply chain disruptions to strategic mitigation steps being taken across the industry. For digital leaders managing large-scale transformation, understanding these dynamics is key to staying ahead—before cost pressures ripple into service delivery and long-term competitiveness.

Maximize Azure Efficiency and Savings

Hardware Bottlenecks and Semiconductor Supply Chain Risks

While tariffs have undeniably increased the costs associated with data center construction, another pressing issue worsens these challenges: the global shortage of semiconductors and critical hardware components. This scarcity not only inflates prices but also introduces significant delays in the procurement and deployment of essential infrastructure.

Semiconductor Shortages Impacting Data Center Hardware

The rapid advancement of AI and high-performance computing has led to an unprecedented demand for semiconductors, particularly high-bandwidth memory (HBM) chips vital for AI workloads. Manufacturers like SK Hynix and Micron have reported that their HBM chip supplies are sold out through most of 2025, creating bottlenecks in data center GPU availability and hindering expansion plans.

Beyond HBM chips, the shortage extends to other critical components such as switches, routers, and power distribution units (PDUs). These components are essential for data center operations, and their scarcity is causing delays in infrastructure deployment and increasing costs.

Geopolitical Risks and Supply Chain Vulnerabilities

The semiconductor supply chain’s heavy reliance on specific regions makes it susceptible to geopolitical tensions and natural disasters. For instance, the temporary closure of high-purity quartz mines in Spruce Pine, North Carolina, due to Hurricane Helene has threatened the global supply of silicon wafers, a fundamental component in semiconductor manufacturing.

Moreover, trade restrictions and export controls are worsening supply chain disruptions. The U.S. government’s imposition of tariffs on steel, semiconductors, and critical components is altering the cost structure of data center operations and affecting the availability of essential materials.

Strategic Responses and Mitigation Efforts

In response to these multifaceted challenges, data center operators and cloud service providers are adopting several strategies:

Supply Chain Diversification: Companies are seeking alternative suppliers in regions less affected by geopolitical tensions to mitigate risks associated with concentrated supply chains.

Investment in Domestic Manufacturing: Initiatives like the CHIPS and Science Act aim to bolster domestic semiconductor production, reducing reliance on foreign sources.

Cloud Migration: Organizations are increasingly moving workloads to the cloud as a temporary solution to hardware shortages, using the scalability and flexibility of cloud services.

Direct Impact on Data Center Construction Costs

Notably, suppliers and manufacturers have reported that the increased tariffs on metals and electronic components have resulted in a noticeable rise in material costs, thereby driving up overall data center construction costs. This has significant implications for cloud computing expansion, as higher input expenses force cloud service providers to reconsider their capital expenditure plans.

Steel and Aluminum Price Increases:

- Tariffs on steel and aluminum—key materials in both structural frameworks and power infrastructure—have increased by 25% for imported goods.

- Construction firms have seen that these price hikes are being passed on by suppliers, leading to higher budgets for new data center buildouts.

- As many data centers rely on components manufactured overseas, providers are facing a direct impact on their cost models.

Electrical and Cooling Equipment Costs:

- Increased tariffs on essential electrical equipment, including transformers and switchgear, are inflating power distribution system expenses.

- Cooling systems, which often incorporate imported electronic components, are also seeing a cost uptick due to higher duty fees on these parts.

- The heightened tariffs are forcing contractors and facility planners to adjust their procurement strategies, either by sourcing alternative suppliers or absorbing the higher costs into project budgets.

Impact on Overall Project Budgets:

- Preliminary assessments suggest that the tariffs have raised the input costs for data center construction projects noticeably, with some reports showing a multi-percentage point increase in overall project expenses.

- For many cloud service providers, an increase in data center construction costs demands a careful reassessment of project timelines and investment returns.

- This cost pressure may result in adjustments of expansion plans or delays in new project green lights until supply chain stability is reestablished.

Materials Affected:

- Metals: Tariffs on imported steel and aluminum (25%) directly increase costs for structural frameworks and power infrastructure.

- Electrical Components: Higher duties on items such as transformers and switchgear add to power distribution expenses.

- Cooling Systems: Imported cooling equipment sees increased pricing due to tariffs on essential electronic components.

Economic and Investment Implications:

Providers in the cloud computing industry are now revising financial models due to increased data center construction costs.

Cloud service providers are reassessing their capital expenditure plans as tariff implications add financial pressure on the bottom line.

The overall rise in costs is prompting many companies to examine alternative sourcing strategies and regional production options to moderate the impact.

During this period, market analysts have confirmed that cloud computing expansion faces direct cost challenges from these tariffs. As the tariffs continue to affect supply chains, technology leaders are pressed to balance cost increases with the strategic need to make sure services are priced competitively. Cloud service providers must now account for these higher data center construction costs factors in their financial forecasts and operational planning.

Supply Chain Disruptions and Component Availability

Industry analysts have reported that many parts essential for cloud computing expansion are now experiencing longer lead times and reduced availability, directly influencing overall data center construction costs and the operational planning of cloud service providers.

In March 2025, suppliers began to face challenges as tariffs increased the cost of imported components from key regions like China, Taiwan, and South Korea. While certain high-value semiconductor components received temporary tariff exemptions, many critical items—such as electrical equipment, cooling infrastructure parts, and assembly components—are not exempt. This situation is causing delays and prompting manufacturers to reexamine their procurement strategies. As organizations strive to meet scheduled project deadlines, they are also dealing with heightened uncertainty regarding the timing and pricing of these vital components.

Key observations from recent reports include:

- Extended Lead Times and Reduced Stockpiles:

- Suppliers are experiencing significant delays in the delivery of essential parts. This includes critical items for power distribution systems and environmental control equipment that data centers need.

- Increased tariffs have reduced profit margins along supply chains, leading some suppliers to reduce inventory levels or postpone new production runs.

- Shift in Manufacturing Sources:

- In response to tariffs, several manufacturers have started discussions to source alternative suppliers from regions that have lower duty rates.

- Cloud service providers are now weighing the benefits of alternative sourcing against potential increases in data center construction costs, as shifting supply may involve higher shipping costs or lower production volumes.

- Contract Renegotiations and Inventory Stockpiling:

- With the cloud computing industry under pressure from tariff implications, many cloud service providers are renegotiating contracts with overseas vendors to include clauses that address supply delays and cost fluctuations.

- Some companies have begun stockpiling critical components to cushion the impact of temporary supply shortages, although this approach raises upfront costs.

- Increased Operational Uncertainty:

- The overall unpredictability around the availability of components is forcing key decision-makers within the cloud computing industry to revise project timelines.

- Cloud service providers are now closely watching out for potential supply delays and cost escalations more closely, which can affect both current projects and plans for cloud computing expansion.

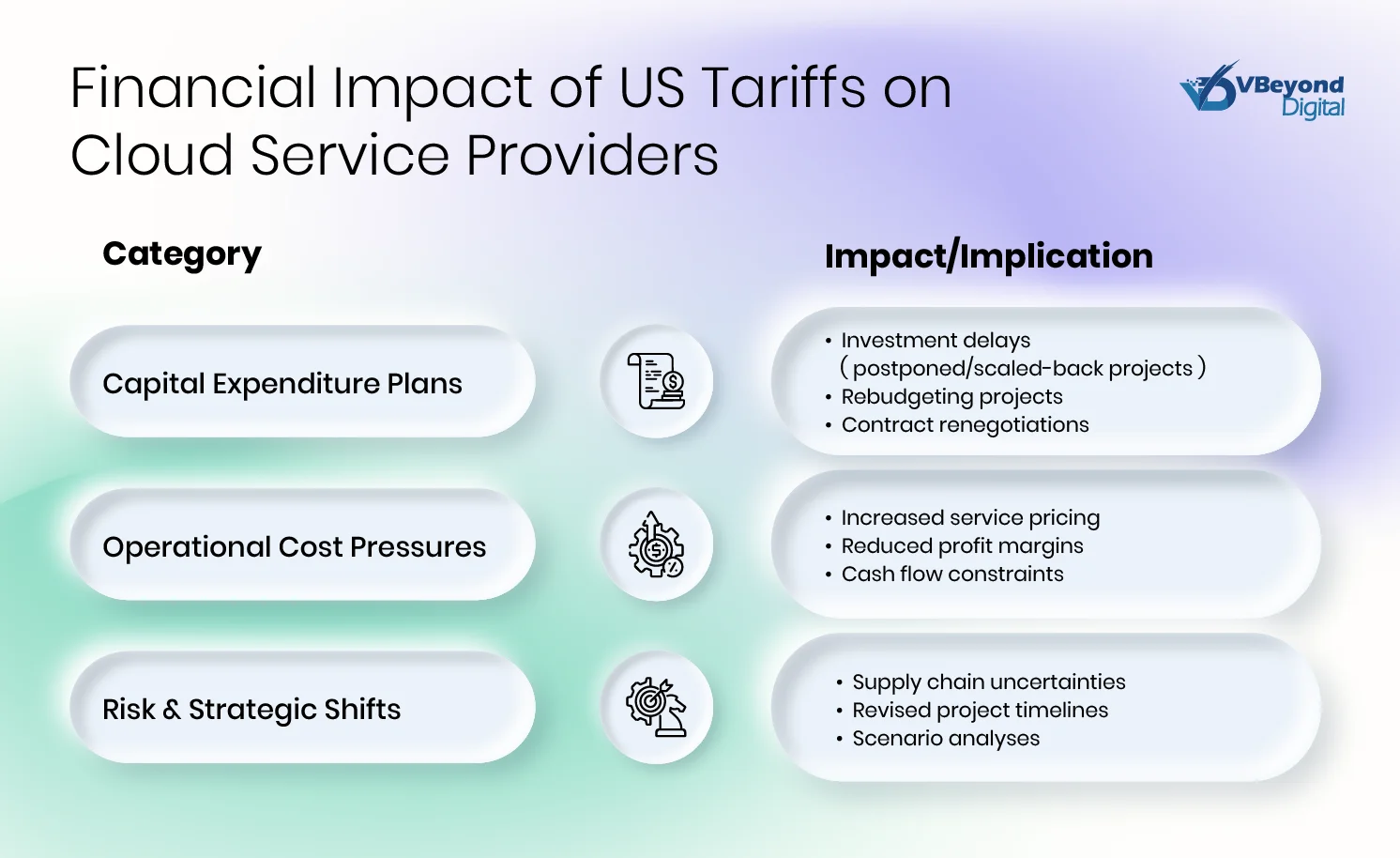

Financial Implications for Cloud Service Providers

In March and April 2025, the impact of the recent US tariff imposition has extended beyond increasing data center construction costs. This has also introduced significant financial pressures for cloud service providers, prompting changes such as:

Revised Capital Expenditure Plans:

- Investment Delays: Several cloud service providers, including industry giants, have postponed or scaled back data center expansion projects in response to the higher costs. Investment decisions are being closely reexamined as tariffs seem to lead to higher costs for imported servers, electrical components, and cooling systems.

- Rebudgeting Projects: Ongoing projects are now being re-evaluated to factor in added expenses from tariff implications, with many providers adjusting their long-term financial plans to account for an overall increase in data center construction costs.

- Contract Renegotiation: Providers are in negotiations with suppliers to update long-term contracts and secure better terms amid the new US tariff imposition. Discussions focus on mitigating the immediate monetary impact while safeguarding the operational continuity of existing facilities.

Operational Cost Pressures:

- Increased Service Pricing: With higher input costs, many cloud service providers face the challenge of balancing increased operational expenses with the need to ensure competitive pricing. There are growing concerns that these tariffs could eventually lead to higher service prices for customers, even as providers try to absorb some of the cost hikes.

- Profit Margin Adjustments: Financial models across the cloud computing industry are being adjusted due to the increased costs of building and running data centers. Providers are closely tracking their margins and profit forecasts as tariff implications force them to consider alternative supply chain arrangements or regional sourcing strategies.

- Impact on Cash Flow: The higher upfront costs linked to tariffs and the expected rise in data center construction costs are pressuring the short-term cash flows of many technology companies. This situation underscores the need for tighter financial management and a re-prioritization of capital investments.

Risk Management and Strategic Shifts:

- Diversification of Supply Sources: In response to the tariffs on key components from China, Taiwan, and South Korea, some cloud service providers are actively seeking suppliers from regions with lower or no tariffs. These efforts are aimed at preventing rising costs and ensuring that the increased data center construction costs do not severely affect project timelines or service availability.

- Revised Project Timelines: Given the uncertainties introduced by the tariff implications, companies are preparing for potential delays. Financial planning now incorporates longer lead times for key components, and project managers are adopting more cautious scheduling approaches to accommodate supply chain variability.

- Scenario Analysis: Financial advisors within the cloud computing industry are conducting scenario analyses to evaluate the long-term impact of US tariff imposition. These analyses help companies understand the potential ripple effects of cloud computing expansion and figure out strategies to mitigate risk while ensuring a steady pace of growth. Here, some key financial considerations include:

Capital Expenditure Adjustments:

- Investment postponements and budget realignments due to increased costs.

- Contract renegotiations with overseas suppliers to manage tariffs.

Operational and Profit Pressures:

- Anticipated increase in service pricing affecting customer demand.

- Reduction in profit margins owing to higher construction and operational expenses.

Strategic Reactions:

- Assessments of alternative sourcing and domestic manufacturing options.

- Scenario analysis and revised project scheduling to absorb tariff implications.

Strategic Responses and Mitigation Efforts

As a direct result of the recent US tariff imposition measures, cloud service providers and data center developers have reacted by reassessing their supply chains and project planning. With tariffs raising data center construction costs, companies in the cloud computing industry are adopting multiple strategies to counteract the financial pressures.

Here’s how the industry is responding:

Supply Chain Diversification:

- Several providers have started discussions with alternative suppliers in regions that do not face high tariff implications. This approach aims to reduce dependence on countries where tariffs have sharply increased material costs.

- Cloud service providers are renegotiating contracts to secure more stable pricing and longer-term supply commitments due to higher costs caused by the US tariff imposition.

- Short-term measures such as inventory stockpiling are being employed to cover anticipated delays until new supplier arrangements are made.

Domestic Production Initiatives:

- Reports from April 2025 indicate that major companies are investigating options to source critical components through domestic channels to mitigate the adverse effects of tariffs.

- Some industry leaders have initiated feasibility studies to assess the technical and financial aspects of transferring production processes into the United States. Although such shifts require significant investments and time, these studies aim to reduce future reliance on global supply chains that are vulnerable to tariff implications.

Operational Adjustments:

- Providers are scrutinizing the overall budget for cloud computing expansion projects, recognizing that higher data center construction costs require reallocation of capital and a careful review of project timelines.

- Several organizations have temporarily adjusted their project schedules and capital expenditure plans while awaiting more stable pricing in the global market.

Detailed Negotiations with Suppliers:

- In early April 2025, cloud service providers began structured negotiations with international suppliers to address increased costs due to tariffs.

- These negotiations focused on revising contract terms to include flexible pricing that reflects real-time changes in tariff implications, ultimately aiming to reduce the burden on project budgets.

Broader Economic and Industry Implications

Macroeconomic Pressure

- Financial markets have recorded sharp movements following the tariffs. Stock indices have experienced heightened volatility with significant daily losses in global equity markets. These fluctuations are indicative of investor unease around sustained cost pressures and broader economic uncertainty.

- Inflationary concerns have risen among both cloud service providers and the construction industry. As the tariffs add to the cost of imported goods, the increased data center construction costs are expected to contribute to higher operating expenses, which may eventually put upward pressure on service prices.

Impact on Industry Investment and Growth

- The added costs from tariffs have led several industry leaders to reconsider their budgets for cloud computing expansion. With significant investment already committed to data center construction, any increase in input costs forces a reevaluation of return on investment calculations, slowing down new projects.

- For cloud service providers, the higher costs and extended lead times across the supply chain will delay deploying new facilities. This outcome may limit the pace at which the cloud computing industry expands in the short term and create a gap between projected service growth and actual expansion.

Sector-Wide Adjustments

- The cloud computing industry is now taking a closer look at its contracts and supply chain arrangements to minimize the impact of tariffs. Many providers are working to adjust their sourcing strategies, aiming to shift part of their operations to domestic production or alternative regions with lower tariff rates.

- The increased data center construction costs have prompted discussions among cloud service providers to combine their spending on current projects rather than starting new ones until a more stable trade environment is restored.

Stakeholder Concerns and Market Confidence

- Investors in the cloud computing industry are closely monitoring these tariff implications. The volatility in the stock market and concerns about cost escalation have led to cautious investment behaviors. Analysts warn that prolonged tariff pressures could slow technology sector growth, affecting both short-term earnings and long-term strategic planning.

- Policy discussions and ongoing negotiations with international trade partners during this period have shown that some countries are seeking ways to limit countermeasures, a factor that can have secondary effects on the cost structure and competitiveness of cloud service providers.

Conclusion

The sharp upward movement in costs for essential materials—from metals used in building structures and power systems to the vital components for environmental control—has raised concerns about meeting project timelines and maintaining competitive pricing. The tariffs have affected immediate costs and created uncertainties in component availability, contributing to further delays in data center projects. These tariff implications are prompting industry leaders to consider short-term measures such as stockpiling and renegotiating supplier contracts, while also assessing longer-term strategies like shifting portions of the supply chain to domestic production.

In addition, the financial effects are clear in several major cloud service providers having to change their investment strategies amid concerns over rising expenses. With higher costs integrated into new projects, the entire chain—from procurement to project scheduling—faces increased caution. As stakeholders balance these pressures, the immediate focus is still on managing the added data center construction costs without compromising service performance.

FAQs (Frequently Asked Question)

The U.S. government implemented a baseline tariff of 10% on nearly all imports while imposing higher rates on specific countries. For example, Chinese products face an additional 34% duty, Taiwanese imports incur a 32% tariff, and goods from South Korea are subject to a 25% duty. These tariffs are part of the latest US tariff imposition effort.

The increased duties have raised the prices of critical materials such as steel, aluminum, electrical components, and cooling systems. As a result, the overall data center construction costs have increased, impacting project budgets and forcing cloud service providers to revise cost estimates in the cloud computing industry.

Tariff implications have extended lead times, reduced component availability, and forced suppliers to adjust inventory levels. These disruptions have affected key parts needed for data center construction. Cloud service providers are now negotiating with suppliers and seeking alternatives to maintain prompt deliveries.

Faced with rising data center construction costs and supply delays, many cloud service providers are postponing new projects and renegotiating existing contracts. They are reviewing budgeting practices and exploring alternative sourcing from regions with lower or no tariffs to minimize the financial impact on cloud computing expansion.

The tariffs have contributed to increased input costs, market volatility, and inflation concerns. These factors pressure not only the cloud computing industry but also other sectors, affecting investment decisions and prompting adjustments in financial models due to the higher overall cost structure.

Manufacturers are adopting several strategies, including stockpiling critical components and engaging in contract renegotiations with suppliers. They are exploring alternative sourcing options to reduce reliance on regions subject to high tariffs. These actions aim to lessen the impact on data center construction costs while sustaining operations for cloud service providers.

Key challenges include increased data center construction costs due to higher material prices and supply delays. Cloud service providers face tightened project timelines, adjusted budgets, and intensified pressure to maintain competitive pricing while absorbing the cost increases driven by tariffs.

US tariff imposition has raised prices on essential components, causing suppliers to reduce inventories and extend lead times. These tariff implications create uncertainty and force companies to look for alternative production sources, which in turn disrupts global supply chains across the cloud computing industry.

Technology leaders are advised to review project budgets and timelines closely, revise financial plans to reflect the increased data center construction costs, and negotiate favorable terms with suppliers. Staying informed on ongoing tariff negotiations is critical for making sound decisions in this volatile environment, ultimately supporting cloud computing expansion.