Section

Banking on Analytics: Enhancing Customer Experience in Banking with Power BI

Section

Table of Contents

- Deploying Power BI to Understand Customer Needs

- Power BI for Customer Segmentation

- Looking Deeper into Data: Predictive Analytics and Customer Retention with Power BI

- Optimizing Customer Support with Power BI

- Implementing Power BI: A Blueprint for Success

- Monitoring Success: KPIs and ROI from Power BI Deployment

- Conclusion

Section

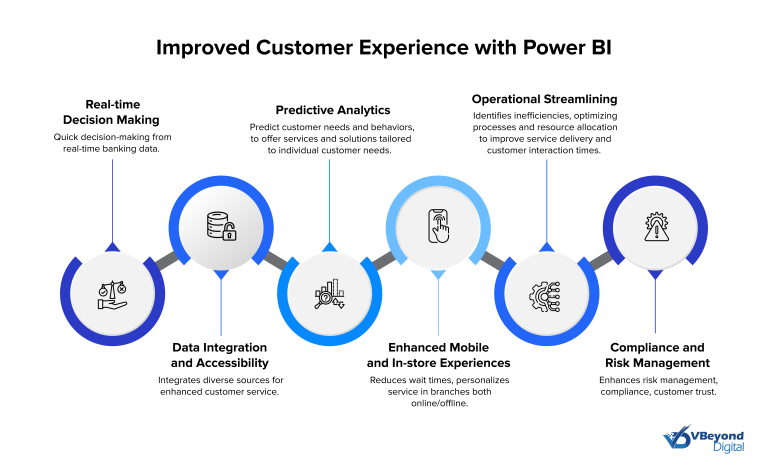

In the finance dynamics, banks are increasingly turning to advanced analytics to better understand and serve their customers. This blog post examines how Microsoft’s Power BI tool is being employed by financial institutions to sift through extensive data sets and refine customer interactions.

The post highlights critical ways in which Power BI assists banks in customizing their services to better fulfill individual customer needs. It discusses specific features like real-time data analysis, predictive analytics, and personalized dashboards that enable financial professionals to offer more tailored products and faster, more accurate responses.

By the conclusion of the blog, readers will gain a clear insight into the transformative potential of Power BI in the banking sector and how to leverage these tools in their own organizations.

Section

In finance, the ability to analyze customer data swiftly and accurately can improve customer experiences. Banks are increasingly turning to advanced analytics to gain deeper insights into customer behaviors and preferences, which in turn aids in fine-tuning their services and offerings.

Power BI enables banks to access vast amounts of data generated from various customer interactions. This data, when effectively processed and visualized, allows financial institutions to make informed decisions that can profoundly influence customer satisfaction and loyalty. Whether it’s by making financial reporting more robust and detailed or implementing predictive analytics for customer retention, Power BI offers a robust platform for transforming data into actionable insights.

Section

Section

Enhance banking CX with Power BI—Learn more!

Section

Deploying Power BI to Understand Customer Needs

Power BI is an integrated solution with various levels of capabilities that can help banks understand their clients by looking behind the data and take more informed, data-driven decisions with respect to delivering and improving their core offerings. The shift to a business intelligence solution like Power BI can especially be helpful for small and mid-sized banks in responding to digital customer behaviors and preferences by analyzing various performance metrics and accessing deeper insights on them, which are often hidden in plain sight within traditional data sets and not possible to derive from Excel reports alone.

Real-Time Data for Personalized Service

One of Power BI’s most significant advantages is its capability for real-time data processing. This feature allows banks to respond instantly to customer needs, providing personalized service that can adapt to changing conditions and behaviors.

For instance, if a customer frequently overdraws their account, Power BI can help identify this pattern. The bank can then proactively offer overdraft protection or financial planning services, directly addressing the customer’s needs before they escalate.

Visualizing Customer Data

Through dynamic dashboards and interactive reports, Power BI helps stakeholders visualize complex datasets. This visualization aids in identifying trends such as peak transaction times, most used banking services, and customer feedback scores.

By understanding these trends, banks can adjust their operations to better serve their customers, ensuring resources are appropriately allocated during high demand times and enhancing overall customer satisfaction.

Section

Power BI for Customer Segmentation

Effective customer segmentation is critical in tailoring banking services and communication to meet diverse customer needs. Power BI provides sophisticated tools that enable banks to segment their customer base more accurately and dynamically, leveraging both demographic and behavioral data.

Sophisticated Segmentation Techniques

With Power BI, banks can create detailed customer profiles based on a variety of criteria such as spending habits, account types, age, and geographical location. This granular segmentation helps in devising targeted marketing campaigns, personalized product offerings, and even risk assessments.

For example, young professionals might be targeted with investment products for early retirement planning, while students might receive offers for no-fee checking accounts or student loans.

Improving Customer Interactions with Real-Time Analytics

Power BI is pivotal in enhancing customer touchpoints such as ATMs, online banking portals, and mobile banking apps through real-time analytics. This ability to analyze and act upon data instantaneously helps banks to not only meet but exceed customer expectations at various interaction points.

Real-Time Adjustments to Banking Strategies

By integrating Power BI’s real-time analytics capabilities, banks can monitor customer interactions as they happen. This monitoring enables immediate adjustments to services based on customer behavior and feedback. For example, if a bank notices a sudden increase in mobile app transactions during certain hours, it can allocate more resources to ensure the app’s performance remains optimal during those peak times.

Improving Customer Service Delivery and Benchmarks

Real-time data can also help in refining customer service strategies. Suppose a bank’s data indicates a high frequency of customer service calls related to online transaction difficulties. In response, the bank could use Power BI to identify and address specific issues within the online banking system, improving usability and reducing future calls. Additionally, this proactive approach can lead to more tailored communications and problem-solving initiatives, directly enhancing customer satisfaction.

Section

Looking Deeper into Data: Predictive Analytics and Customer Retention with Power BI

Power BI’s predictive analytics capabilities offer profound insights that can help banks anticipate customer needs and effectively prevent churn. This proactive approach not only enhances customer satisfaction but also fortifies customer loyalty by demonstrating a bank’s commitment to their clients’ financial well-being.

Forecasting Customer Needs with Predictive Analytics

By utilizing predictive models, Power BI can analyze historical data to forecast future customer behaviors and preferences. This foresight enables banks to offer personalized services before customers explicitly express a need, thereby enhancing customer experience and engagement. For instance, predictive analytics can identify customers likely to seek mortgage advice based on their saving patterns and direct communication about mortgage options to them proactively.

Proactive Customer Retention Strategies

Predictive analytics also allows banks to identify early signs of customer dissatisfaction or potential churn. By recognizing these signs, banks can take preemptive actions to address concerns and improve customer relationships. For example, a customer consistently experiencing transaction issues might be offered dedicated support or even incentives, which could mitigate frustration and reduce the risk of them switching to a competitor.

Section

Optimizing Customer Support with Power BI

Power BI provides banks with advanced tools to streamline their customer support operations, enhancing both efficiency and the quality of service provided to customers. By analyzing support interactions and performance metrics, Power BI can identify areas for improvement and help implement effective solutions.

Streamlining Customer Support Processes

Power BI enables banks to monitor and analyze various elements of customer support, such as response times, resolution rates, and customer satisfaction scores. This overarching reporting capability is crucial for identifying bottlenecks and inefficiencies within these individual elements and processes. For example, if data shows that customer wait times are longest during specific hours, a bank can use this insight to adjust staffing levels or implement more automated solutions during those peak times.

Improving Resolution Times

By leveraging Power BI’s analytics, banks can reduce the time it takes to resolve customer issues. Analyzing patterns in customer queries and resolutions can help identify common problems and enable banks to develop quicker and more effective solutions. Additionally, this analysis can be used to train customer support staff more effectively, equipping them with the tools and knowledge to handle inquiries with greater proficiency.

Enhancing Training and Performance Monitoring

Power BI also plays a crucial role in training and monitoring the performance of customer support staff. By visualizing performance data, managers can provide personalized coaching and support to help staff meet and exceed service standards. Furthermore, this data can be used to recognize and reward high-performing employees, fostering a motivated and competent customer service team.

Section

Implementing Power BI: A Blueprint for Success

Integrating Power BI into a bank’s strategic and decision-making framework requires a structured approach to ensure smooth adoption and maximize benefits. In this section, we outline the critical steps for successful Power BI implementation, along with the technical prerequisites and potential challenges.

Steps for Successful Power BI Implementation

- Assessment and Planning:

Conduct a thorough assessment of the current data infrastructure and capabilities.

Identify key stakeholders and define specific goals for the Power BI implementation.

- Data Integration and Management:

Ensure that data from various sources (e.g., CRM (Customer Relationship Management) systems, transaction databases) can be seamlessly integrated into Power BI.

Implement robust data governance practices to maintain data accuracy and security.

- Customization and Configuration:

Customize dashboards and reports to meet the specific needs of different departments within the bank.

Configure Power BI to deliver real-time analytics and automated insights wherever possible.

- Training and Development:

Provide comprehensive training for all users, focusing on how to utilize Power BI to extract and interpret data effectively.

Develop an ongoing education plan to keep staff updated with new features and best practices.

- Deployment and Monitoring:

Deploy Power BI solutions in phases, starting with a pilot program to gather feedback and make necessary adjustments.

Monitor the system continuously for performance issues and user adoption, adjusting as needed.

Technical Prerequisites and Challenges

- Technical Prerequisites:

Adequate server and network infrastructure to handle large volumes of data.

Integration capabilities with existing IT systems and databases.

Expertise in data analytics and management within the IT team.

- Challenges in Implementation:

Ensuring data consistency and quality across various sources.

Overcoming resistance to change among staff accustomed to traditional data analysis tools.

Balancing the need for comprehensive data access with stringent security requirements.

Also read our blog on “Creating Data-Driven Strategies for Sales and Marketing with Power BI”

Examples of Effective Power BI Implementations

- Brown-Forman: Brown-Forman Corporation, known for its brands like Jack Daniel’s, used Power BI in conjunction with Power Automate and other Microsoft solutions to streamline operations and improve efficiency. The integration helped save thousands of hours within the first few months by automating routine tasks and enhancing data integration across platforms like Salesforce and Workday.

- City of Kobe: During the COVID-19 crisis, the City of Kobe utilized Power BI along with other components of the Microsoft Power Platform to manage crisis response effectively. This included tracking special cash payments and providing vital information through chatbots and dashboards, demonstrating the platform’s utility in managing real-time public service responses during emergencies.

- FortisAlberta: In the utilities sector, FortisAlberta implemented Power BI to enhance their safety programs. This project not only won a Canadian Safety Technology Award but also facilitated a more efficient documentation process for their Injury Prevention Plans (IPPs), moving from paper-based to digital solutions. The transition enabled real-time data access and more effective communication across the organization.

Section

Monitoring Success: KPIs and ROI from Power BI Deployment

To effectively measure the impact of Power BI on enhancing customer experiences in banking, it is crucial to identify and track specific key performance indicators (KPIs). These KPIs help banks quantify the improvements in service delivery and operational efficiency, providing a clear picture of the return on investment (ROI) from Power BI implementations.

Key Performance Indicators for Success

- Customer Satisfaction and Retention Rates:

Tracking changes in customer satisfaction through surveys and feedback before and after Power BI implementation.

Monitoring retention rates, particularly following targeted campaigns and service improvements driven by insights from Power BI.

- Operational Efficiency:

Measuring the reduction in time spent generating reports and analyzing data.

Assessing improvements in customer service response times and resolution rates.

- Financial Performance:

Analyzing the impact of targeted marketing and personalized service offerings on sales and revenue.

Evaluating cost savings resulting from more efficient operational processes.

Section

Conclusion

The strategic deployment of Power BI in the banking sector offers substantial advantages for enhancing customer experiences and operational efficiencies. By providing deep insights into customer behaviors and preferences, Power BI enables banks to not only meet but exceed customer expectations. The integration of this powerful analytics tool into banking operations is pivotal in a highly competitive industry where data-driven strategies reign supreme. Power BI stands out as an essential component in the modern banking toolkit for all levels of business decision-making. Banks that effectively implement the solution and take advantage of its capabilities will find themselves well-equipped to maintain a leading edge in customer satisfaction and financial performance.