Advanced Serverless Architecture: Scaling with Azure Functions Beyond Basics

Section

Table of Contents

- Introduction: The Shift Towards Serverless Cloud Computing Solutions in Finance

- Unpacking Serverless Cloud Computing: The Core Concepts

- Deep Dive into Azure Functions

- Strategies for Scaling Azure Functions

- Implementing Robust Event-Driven Architectures for Finance

- Enhancing Security and Compliance

- Advanced Monitoring and Performance Optimization

- Building Resilient and Disaster-Proof Architectures

- Anticipating the Future of Serverless Cloud Computing

- Conclusion: Advanced Serverless Cloud Computing Architectures in Finance Conclusion

Section

In this comprehensive guide, we explore the advanced capabilities of serverless cloud computing with Azure Functions. As businesses increasingly shift towards serverless architectures, understanding how to effectively scale and optimize these systems becomes crucial. This blog dives deep into the strategies and techniques for enhancing Azure Functions, offering practical advice for deploying, monitoring, and maintaining high-performance applications in a serverless cloud environment. Whether you’re a seasoned developer or new to cloud computing, this article provides the insights you need to take full advantage of Azure’s powerful serverless offerings.

Introduction: The Shift Towards Serverless Cloud Computing Solutions in Finance

The rise of digital financial services and fintech products has brought about a pressing need for adaptable, scalable, and efficient computing solutions. Traditional infrastructure can no longer keep up with the growing demands for real-time processing, security, and flexibility. Serverless computing offers a solution by eliminating the complexity of managing servers, allowing businesses to focus on innovation rather than maintenance.

Azure, with its wide array of capabilities, stands out as a leading platform for serverless solutions. Azure Functions, in particular, provides financial services with automatic scaling, cost-effective operations, and robust security, making it the ideal tool to support the fast-paced fintech landscape.

In this blog, we explore how Azure Functions can be scaled beyond basic implementations, supporting the development of complex, event-driven systems that are pivotal for real-time data processing and decision-making in financial services and fintech.

Unpacking Serverless Cloud Computing: The Core Concepts

Serverless computing, a key facet of modern IT strategies, particularly in finance, removes the complexity of hardware management and focuses on delivering purely business value. At the heart of serverless computing in the Azure ecosystem are two core models: Backend as a Service (BaaS) and Functions as a Service (FaaS). BaaS provides backend services on-demand to applications, such as databases (Azure Cosmos DB) and storage solutions (Azure Blob Storage), directly accessible via the cloud. FaaS, represented by Azure Functions, allows developers to execute pieces of code in response to events, such as changes in data or new user input, without maintaining servers.

The rise of serverless cloud computing has notably influenced serverless computing trends, as businesses embrace the scalability and reduced overhead that these models offer. By leveraging these services, financial institutions can significantly speed up their application development cycles, react more swiftly to market changes, and reduce operational costs, all while maintaining high security and compliance standards.

Deep Dive into Azure Functions

Azure Functions, a pivotal element of serverless architecture, extends far beyond basic cloud functions, offering a scalable and efficient way to manage code execution in the cloud. As an integral component of Azure architecture, it supports a variety of programming languages and integrates seamlessly with other Azure services, thereby enhancing the serverless cloud computing experience.

Azure Functions is designed to handle complex, event-driven applications, making it an ideal choice for financial institutions that require real-time processing capabilities. With features such as automatic scaling, integrated security, and built-in monitoring tools, Azure Functions allows organizations to focus on innovation rather than infrastructure management.

Advanced Features and Integration Capabilities

- Automatic Scaling: Azure Functions scales automatically based on demand, adjusting resources in real-time to handle peaks in workload without any manual intervention.

- Integrated Security: Leveraging Azure’s robust security framework, Azure Functions ensures that all functions are protected with Azure Active Directory and provides easy ways to connect securely to other Azure services.

- Monitoring Azure Functions: With Azure Monitor, organizations can track performance, monitor operations, and ensure the health of their functions. This tool provides deep insights and analytics, enabling proactive troubleshooting and performance optimization.

Azure Functions, by enabling backend as a service (BaaS) and functions as a service (FaaS), revolutionizes how financial services approach technology solutions, offering both flexibility and power without the overhead of traditional server management.

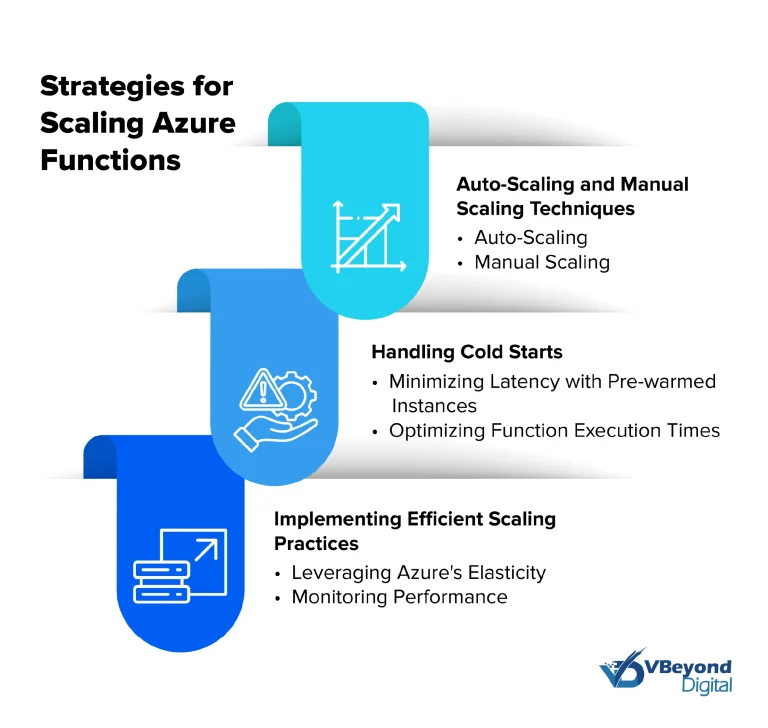

Strategies for Scaling Azure Functions

Scaling Azure Functions effectively is crucial for financial institutions that manage large volumes of transactions and require high availability and responsiveness. Azure provides robust scaling capabilities that can be tailored to meet the demanding needs of serverless computing environments.

Auto-Scaling and Manual Scaling Techniques

- Auto-Scaling: Azure Functions offers built-in auto-scaling that dynamically adjusts the number of active instances based on the current load, ensuring that performance remains stable under varying loads without manual intervention.

- Manual Scaling: For scenarios where predictable performance is necessary, Azure Functions allows for manual scaling where the number of instances can be specified, providing greater control over the resources.

Handling Cold Starts

- Minimizing Latency with Pre-warmed Instances: Azure Functions can be configured to have pre-warmed instances that help reduce latency during cold starts, ensuring that functions are ready to execute even after idle periods.

- Optimizing Function Execution Times: Techniques such as optimizing the function code and managing dependencies effectively can also help in reducing the impact of cold starts, crucial for time-sensitive financial operations.

Implementing Efficient Scaling Practices

- Leveraging Azure’s Elasticity: Utilizing Azure’s vast network and scalability features, financial institutions can implement a cost-effective scalability strategy that adjusts to real-time demands without over-provisioning resources.

- Monitoring Performance: Continuously monitoring performance using Azure Monitor helps identify scalability needs in real-time, allowing adjustments before performance impacts occur.

Implementing Robust Event-Driven Architectures for Finance

Event-driven architectures are crucial for financial services, where real-time data processing and immediate responsiveness are paramount. Azure Functions excel in facilitating these architectures by allowing financial institutions to react to events as they occur, whether they’re transactions, customer activities, or market changes.

Key Components and Operations

- Azure Functions as Event Processors: Azure Functions serve as the backbone for executing code in response to various triggers such as database updates, service bus queues, or IoT events, ensuring timely actions on critical financial data.

- Integration with Azure Services: Leveraging services like Azure Event Grid and Azure Service Bus, Azure Functions facilitate streamlined event management and communication across different components, enhancing the efficiency of financial operations.

Practical Operations for Financial Applications

- Real-Time Transaction Monitoring: Utilizing Azure Functions allows for the monitoring of transactions in real time, which is critical for fraud detection and compliance.

- Automated Trade Settlements: Financial institutions can automate complex trade settlement processes, reducing the time from trade execution to final settlement.

- Dynamic Risk Assessment: By processing events as they occur, Azure Functions help in assessing and mitigating risks dynamically, adapting to new information instantly.

Analysis of architectures recommended for the finance industry

Architecture | Overview | Technological Focus |

Decentralized Trust Framework for Banks | Explore strategies to create a secure environment for sharing information among financial institutions without relying on a central database. | Blockchain |

Mainframe Data Synchronization with Azure | Implement strategies to synchronize mainframe data with Azure to support the digital transformation of legacy banking systems. | Mainframe |

Mainframe and Midrange Data Modernization | Comprehensive modernization strategy for updating mainframe and midrange data systems. | Mainframe |

Azure Refactoring for IBM z/OS Mainframe CF | Utilize Azure services to enhance scalability and reliability, matching the performance of IBM z/OS mainframe Coupling Facilities. | Mainframe |

Cloud Transformation of Banking Systems | Examination of how a leading bank upgraded its transaction processing system to be compatible with existing payment mechanisms while transitioning to the cloud. | Migration |

Design Patterns for Banking System Transformation | Investigation into the architectural patterns and practical implementations that support cloud transformation of banking systems. | Migration |

Case Study: Centralized CRM Operations in Azure for a Major Financial Service Provider

Problem: A prominent global banking and financial services company faced significant challenges in managing and centralizing customer data across multiple geographical locations and systems. Their existing process was plagued by inefficiencies due to manual operations, which led to data losses and potential security breaches. The bank struggled with integrating disparate customer data sources, including KYC apps and customer portals, which lacked consistency and exposed them to the risk of data breaches.

Solution: To address these challenges, the organization implemented Azure Function Apps to automate and centralize their CRM operations. The solution involved creating batch jobs within Azure to process and integrate data from various sources into their CRM system, Dynamics 365, in real-time. This integration not only streamlined data processing but also enabled dynamic data handling, where changes were automatically updated in the CRM. Azure Service Bus and Azure Key Vault were also utilized to ensure secure and efficient data transfer.

Benefits: The deployment of Azure Function Apps transformed the bank’s data management and CRM operations, resulting in a 65% reduction in costs and a 40% decrease in manual tasks. This centralization provided a single, consistent data repository, which improved error handling and incident management, ensuring the safety and privacy of sensitive customer information. The solution also enhanced the scalability of their database, preparing it for future expansion without impacting existing data sets.

For more details on how financial services can leverage Azure for innovative solutions, you can explore additional insights and case studies on the Microsoft Azure Architecture Center for Financial Services.

Enhancing Security and Compliance

In the financial sector, where data sensitivity and regulatory compliance are paramount, enhancing the security and compliance of serverless architectures is crucial. Azure Functions provides a secure serverless computing environment that meets stringent industry standards, ensuring that financial institutions can leverage serverless cloud computing without compromising on security.

Integrated Security Features in Azure Functions

- Authentication and Authorization: Azure Functions supports integration with Azure Active Directory, enabling robust authentication and authorization mechanisms. This ensures that only authorized users and systems can access functions.

- Network Security: Capabilities like Virtual Network integration and private endpoints ensure that Azure Functions can operate within a secure network space, isolating them from public internet threats.

Compliance with Financial Regulations

- Regulatory Adherence: Azure meets a broad set of international and industry-specific compliance standards, such as GDPR, PCI-DSS, and SOX, which are crucial for financial applications. Azure Functions inherits these compliances, providing a framework that facilitates easier compliance with financial regulations.

- Audit Trails and Monitoring: Utilizing Azure Monitor and Azure Security Center, institutions can gain comprehensive insights into operations and security, enabling effective auditing and real-time security monitoring.

Enhancing Data Protection

Encryption and Data Management: Azure provides encryption for data at rest and in transit, coupled with managed identity features for securely accessing other Azure services without storing sensitive credentials in code.

Advanced Monitoring and Performance Optimization

For financial institutions leveraging serverless architectures, especially those using Azure Functions, maintaining optimal performance and managing resources efficiently are critical. Monitoring and performance optimization not only ensure smooth operations but also helps in cost management by avoiding resource wastage.

Monitoring Azure Functions with Azure Monitor

- Comprehensive Monitoring: Azure Monitor provides a suite of tools to track performance, diagnose issues, and understand usage patterns in real-time. It allows teams to set up alerts based on performance thresholds and automate actions based on these alerts.

- Application Insights Integration: For more detailed analytics, integrating Azure Functions with Application Insights offers deeper insights into the application performance and user behaviors, facilitating proactive optimizations and enhancements.

Performance Optimization Strategies

- Code Optimization: Refining the function code to execute more efficiently and consume fewer resources. This involves streamlining the logic, reducing complexity, and optimizing data transactions.

- Dependency Management: Managing and updating dependencies to ensure that Azure Functions are using the most efficient libraries and frameworks, which can significantly impact performance.

Cost Optimization Techniques

- Efficient Resource Utilization: Using Azure’s scaling capabilities to match demand, ensuring that resources are not underutilized or overprovisioned.

- Budgeting and Cost Management: Employing Azure Cost Management tools to track spending and adhere to budgets. This tool provides detailed insights and recommendations tailored to reduce costs without compromising performance.

Building Resilient and Disaster-Proof Architectures

In the financial sector, the resilience of serverless cloud computing architectures is not just beneficial; it’s imperative. The ability to withstand failures and quickly recover is crucial, especially when dealing with financial data and transactions. Azure Functions, integral to creating such resilient architectures, provides tools and frameworks that ensure applications are not only fault-tolerant but also maintain high availability and disaster recovery capabilities.

Designing for Resilience

- Geo-Redundancy: Utilizing Azure’s global infrastructure, financial institutions can deploy their serverless applications across multiple regions. This ensures that even if one region experiences a disruption, the system can continue operating without significant downtime.

- Built-In Redundancy: Azure Functions supports deployment in redundant setups, automatically managing the failover processes to minimize impact on services.

Disaster Recovery Strategies

- Data Replication: Azure Cosmos DB, often used in conjunction with Azure Functions for data storage and operations, supports automatic replication across regions, ensuring data persistence and availability during regional outages.

- Recovery Planning: Azure provides comprehensive tools for disaster recovery planning, including Azure Site Recovery, which helps orchestrate replication, failover, and recovery of workloads and applications across different regions.

Ensuring High Availability

- Application Scaling: Beyond scaling for performance, Azure Functions can be configured for scaling that prioritizes availability, using Azure’s Load Balancer and Traffic Manager to distribute requests efficiently across instances and regions.

- Monitoring and Health Checks: Continuous monitoring with Azure Monitor and automatic health checks enables preemptive identification and resolution of issues before they escalate into failures.

Anticipating the Future of Serverless Cloud Computing

As serverless cloud computing continues to evolve, the financial sector stands to benefit greatly from the advancements in technology and the continuous adaptation of serverless models. With the growing serverless computing trends in serverless computing, the future is poised to offer even more sophisticated capabilities that can enhance efficiency, reduce costs, and foster innovation in financial services.

Emerging Serverless Computing Trends

- Integration with Artificial Intelligence and Machine Learning: As AI and machine learning technologies mature, their integration into serverless architectures will provide financial institutions with enhanced analytical tools for real-time decision-making and predictive analytics.

- Increased Adoption of Multi-Cloud Strategies: Financial institutions are likely to adopt a multi-cloud approach to leverage the best capabilities of various cloud providers, enhancing their serverless architectures’ resilience and flexibility.

Innovations on the Horizon

- Serverless Blockchain Solutions: With the integration of blockchain technology, serverless computing can provide more secure and transparent financial operations, particularly in areas like payments and fraud detection.

- Quantum Computing: As quantum computing progresses, its integration into serverless platforms could drastically increase computing power, offering unprecedented processing speeds that could revolutionize complex financial computations.

Preparing for Future Challenges

- Security and Compliance: As serverless architectures become more complex, maintaining security and compliance will require even more robust strategies to protect sensitive financial data against emerging threats.

- Cost Management in a Scalable Architecture: With the expansion of serverless solutions, effective cost management strategies will be crucial to ensure that financial institutions can maximize their ROI while benefiting from the scalability of serverless computing.

Conclusion: Advanced Serverless Cloud Computing Architectures in Finance

As we wrap up our exploration of advanced serverless architectures using Azure Functions, it’s clear that the potential for transforming financial services through this technology is immense. By adopting serverless solutions, financial institutions can achieve greater scalability, enhance operational efficiency, and foster innovation—all while maintaining stringent security and compliance standards.

To senior executives in the financial sector—CTOs, CEOs, and other decision-makers—embracing serverless cloud computing with Azure Functions can be a game-changer. It allows you to stay ahead of technological trends and meet the evolving demands of your customers and the market. Investing in these technologies today will prepare your organization for the challenges of tomorrow, ensuring you remain at the cutting edge of the financial services industry.