Section

Advancing Banking Fraud Detection and Service Delivery with Azure and Dynamics 365

Section

Table of Contents

- Securing Banking Back-End Infrastructure with Azure: Key Implementation Areas

- Threat Monitoring and Prevention

- Incident Response and Management

- Improve Response Time and Reduce Breach Costs

- Supporting Core Banking Services with Dynamics 365 and Azure

- Evolving Fraud Methods in Banking

- Deploying Machine Learning for Enhanced Fraud Detection

- Automating Customer Services for Efficiency and Satisfaction

- Balancing Fraud Detection with Customer Experience

- Dynamics 365 Integration Challenges and Strategies

- Regulatory Compliance and Ensuring Data Security

- Future Directions in Banking Fraud Detection and Client Services

- Conclusion

Section

In today’s digital banking environment, safeguarding against fraud while enhancing service delivery is paramount. This blog explores how Dynamics 365 Fraud Protection, in collaboration with Azure, provides a robust framework for banks to detect and prevent fraudulent activities effectively. By leveraging cutting-edge technologies such as AI and machine learning, Dynamics 365 Fraud Protection helps banks identify suspicious activities in real-time, ensuring a secure and trustworthy banking experience. Additionally, the integration with Azure enhances the scalability and responsiveness of these systems, enabling banks to adapt swiftly to new threats and deliver superior customer service. Discover the strategic advantages of utilizing these advanced tools in your banking operations.

As 2024 unfolds, banks face both familiar and evolving challenges in fraud prevention, with criminals employing more sophisticated methods than ever before. Recent data from the Federal Trade Commission highlights a disturbing increase in fraud-related losses, which exceeded $10 billion in 2023, a 14% rise from the previous year, with investment frauds alone surging to over $4.6 billion. This escalation emphasizes the critical need for advanced and proactive fraud detection mechanisms.

Microsoft Azure and Dynamics 365 are solutions that can enable banking fraud detection and mitigation, offering specialized solutions for banking enterprises of various sizes. Azure provides a robust array of services, including Azure Security Center, Azure AI, and Azure Blockchain Services, which strengthen the foundational infrastructure. These technologies strengthen a bank’s threat identification and response capabilities and secure the storage and usage of sensitive information, setting a new standard in banking security.

For customer-facing operations, Dynamics 365 equips banking fraud detection with advanced CRM (customer relationship management) tools through its Finance, Sales, and Customer Insights modules. These applications work together to create a dynamic, scalable system for sales, marketing, and customer relationship management (CRM), enabling proactive fraud detection and improving customer service. Together, Azure and Dynamics 365 reshape how banks approach fraud prevention, combining operational effectiveness with strong security measures.

Securing Banking Back-End Infrastructure with Azure: Key Implementation Areas

Identity and Access Management

Azure Active Directory (Azure AD) serves as a cornerstone for identity and access management in secure banking enterprises, providing robust banking fraud detection features like single sign-on, multi-factor authentication, and conditional access policies. These capabilities not only boost security but also standardize access rules for enterprise users, reducing the need for multiple logins and improving accessibility. Organizations using Azure AD have reported significant returns on investment, including improved user productivity, reduced risks of data breaches, and overall IT efficiencies:

- Single Sign-On (SSO): Azure AD’s SSO capabilities allow employees to access multiple applications with a single set of credentials, significantly enhancing user experience and productivity. This consolidation of identity and access management systems saves time and reduces the frustration associated with managing multiple passwords and login procedures.

- Enhanced Security: By enabling advanced features like multi-factor authentication and adaptive risk-based policies, Azure AD helps organizations minimize the risks associated with data breaches. These security measures ensure that only the right users gain access to critical systems, providing a strong defense against unauthorized access.

- Operational Efficiency: Organizations that integrate their systems with Azure AD can achieve considerable IT efficiencies. This integration allows for streamlined provisioning and deprovisioning of user accounts, reduces the need for manual IT interventions, and minimizes system downtimes, which are crucial for maintaining continuous business operations.

Section

Section

Prevent Fraud with Dynamics Now

Threat Monitoring and Prevention

Azure Security Center, now known as Microsoft Defender for Cloud, is pivotal in enhancing the threat monitoring and prevention strategies within banking infrastructures. This comprehensive tool provides not just a unified view across environments but also a set of capabilities to protect, detect, and respond to threats in real time.

- Unified Security Management: Microsoft Defender for Cloud consolidates security management across hybrid and multi-cloud environments, including major platforms like AWS and Google Cloud, offering a holistic view of the security posture, and enabling consistent security management across all assets.

- Advanced Threat Protection: Leveraging advanced analytics and global threat intelligence, Microsoft Defender for Cloud detects emerging threats and potential vulnerabilities in real time. It automates the response to detected threats, significantly reducing the time to remediate issues.

- Additional Security: Integrated within Azure Security Center, Microsoft Defender for Cloud provides extended protection for virtual machines, SQL databases, and more. It enhances security with additional layers such as just-in-time access control, adaptive application controls, and network hardening.

Incident Response and Management

Azure Incident Response services provide comprehensive support for managing security incidents, from detection through recovery. These services leverage Microsoft’s vast cybersecurity expertise and threat intelligence to help organizations effectively respond to threats and restore operations.

- Proactive and Reactive Services: Microsoft Incident Response offers both proactive and reactive support. Proactive services include compromise assessments to detect ongoing or potential threats. Reactive services focus on immediate incident response to evaluate, contain, and remediate cyberattacks.

- Global Expertise: With a global reach and 24/7 availability, Microsoft Incident Response ensures that organizations can respond to threats promptly and efficiently. The team’s expertise is supported by Microsoft’s extensive security intelligence and research capabilities, providing unique insights into threat behaviors and mitigation techniques.

- Collaborative Approach: Microsoft partners with governmental and international cybersecurity entities to enhance its incident response capabilities. This collaboration enables a more robust defense against complex and evolving cyber threats.

Improve Response Time and Reduce Breach Costs

Azure’s comprehensive disaster recovery and backup solutions, particularly Azure Backup and Azure Site Recovery, play a critical role in minimizing the impact of breaches and optimizing response times. These tools offer automated and orchestrated recovery processes that ensure quick restoration of services and data integrity in the event of disruptions, whether accidental or malicious.

- Rapid Recovery: Azure Backup ensures that data across enterprise workloads is easily recoverable in a timely manner, supporting a low recovery point objective (RPO). Azure Site Recovery enhances this by enabling quick failover to cloud environments, drastically reducing the recovery time objective (RTO) which is crucial during a breach incident.

- Automated Processes: By automating the replication and recovery processes, Azure minimizes the manual tasks involved, allowing for faster and more efficient response to incidents. This automation extends to complex scenarios involving multi-site recovery strategies that are essential for large-scale operations.

- Cost Management: The integration of these services into a single Azure environment helps in reducing the overall cost associated with disaster recovery. Azure’s pay-as-you-go model ensures that organizations only pay for the resources they use during an incident, which can be significantly less expensive than maintaining duplicate infrastructure for disaster recovery purposes.

Supporting Core Banking Services with Dynamics 365 and Azure

Dynamics 365 Fraud Protection: A Comprehensive Overview

Dynamics 365 Fraud Protection is designed to meet the specific needs of the banking sector, featuring:

- Account Protection: Enhances detection of account fraud through Adaptive AI, which learns from patterns of legitimate and fraudulent account activities. It includes capabilities for device fingerprinting, fraud protection network awareness, and configurable real-time decision policies, aiming to safeguard account integrity with minimal customer friction.

- Loss Prevention: Employs intelligent machine learning to detect anomalies in transactional activities like returns and discounts. It supports store managers by providing actionable insights and automated tools to quickly mitigate potential losses and prevent in-store leakage.

- Purchase Protection: Utilizes Adaptive AI to continuously adapt to new patterns of payment fraud, thereby helping banks optimize profitability while maintaining transaction security. This feature also enhances transaction acceptance rates by sharing trust knowledge with issuing banks.

Evolving Fraud Methods in Banking

Banking fraud has evolved dramatically with the advancement of technology, making banking fraud detection a dynamic challenge. Here are some of the current trends and the types of fraud that are most prevalent in the banking industry today.

Current Fraud Trends

Fraudsters continually adapt to new security measures, exploiting any vulnerabilities they can find. With the rise of digital banking, some of the most common fraud types now include:

- Phishing and Social Engineering: Attackers deceive bank customers into divulging sensitive information, which is then used for fraudulent transactions.

- Card Not Present (CNP) Fraud: As online transactions increase, so does CNP fraud, where stolen card information is used without the physical card.

- Synthetic Identity Fraud: Fraudsters combine real and fake data to create new identities, used to open fraudulent accounts or lines of credit.

Impact of Technology on Fraud Tactics

The introduction of technologies in banking, such as AI-powered fraud detection and machine learning in banking, has both mitigated and complicated the fight against fraud. On the one hand, these technologies allow for real-time fraud detection and more sophisticated security measures. On the other hand, they present new opportunities for fraudsters, who now use more advanced tactics to bypass these systems.

Dynamics 365 leverages machine learning and predictive analytics in banking to stay ahead of these trends, providing banks with tools that adapt and evolve as quickly as the tactics used by those attempting to commit fraud.

Deploying Machine Learning for Enhanced Fraud Detection

Dynamics 365 utilizes advanced AI and machine learning technologies to transform the banking sector’s approach to fraud detection. These technologies enable real-time analysis and response to potentially fraudulent activities, making Dynamics 365 a powerful banking fraud detection tool.

Predictive Analytics and Behavioral Modeling

Through its predictive analytics capabilities, Dynamics 365 can analyze vast amounts of transaction data to identify patterns that may indicate fraudulent behavior. This includes:

- Anomaly Detection: AI models identify deviations from normal transaction patterns, which could suggest fraudulent activity.

- Behavioral Analytics: By modeling typical customer behavior, Dynamics 365 can flag transactions that deviate from established patterns, offering an additional layer of security.

Real-Time Fraud Detection

The capability for real-time fraud detection in banking with Dynamics 365 employs machine learning algorithms that process transactions as they happen, providing immediate alerts and enabling quick action to prevent fraud. This not only helps in stopping fraud before it causes considerable damage but also enhances the overall responsiveness of fraud management systems.

AI-Powered Decision Making

Machine learning in banking, as integrated into Dynamics 365, facilitates smarter, faster decision-making processes. By automating the analysis of transactional data, Dynamics 365 reduces the reliance on manual reviews and speeds up the response times for detecting and addressing fraudulent activities.

Dynamics 365’s advanced AI capabilities ensure that banks can keep pace with the rapidly evolving techniques used by fraudsters, securing their operations and protecting their clients from potential threats.

Automating Customer Services for Efficiency and Satisfaction

Dynamics 365 significantly enhances the efficiency of customer services in banking through automation. By streamlining routine tasks and client interactions, banks can achieve higher levels of operational efficiency and customer satisfaction.

Enhancing Operational Efficiency

Automation in Dynamics 365 allows banks to:

- Automate Routine Tasks: From account inquiries to transaction processing, automation reduces the manual effort required, allowing staff to focus on more complex customer needs.

- Streamline Client Interactions: Automated responses and self-service options ensure that customer queries are handled quickly and efficiently, reducing wait times, and improving overall service quality.

Improving Customer Experience (CX) and Satisfaction

With Dynamics 365, banks can provide a more personalized customer experience. Automation tools within Dynamics 365 enable:

- Personalized Communication: Automated systems analyze customer data to provide tailored advice and service options, enhancing the relevance and impact of communications.

- Consistent Service Quality: Automation ensures that every customer interaction is handled with the same level of accuracy and attention, regardless of the volume or time of day.

Balancing Fraud Detection with Customer Experience

Using Dynamics 365, banks can adeptly balance rigorous fraud detection mechanisms with seamless customer experience. This balance is crucial, as overly aggressive fraud detection can disrupt genuine transactions and detract from customer satisfaction.

Minimizing Customer Friction

Dynamics 365 employs sophisticated algorithms to differentiate between fraudulent and legitimate activities with high accuracy, minimizing false positives that can lead to customer frustration. This includes:

- Adaptive Risk Thresholds: Dynamics 365 adjusts risk thresholds in real-time based on customer behavior and broader transaction contexts, reducing unnecessary security checks for low-risk transactions.

- Contextual Analysis: By analyzing the context of each transaction, Dynamics 365 can make more informed decisions that enhance accuracy in fraud detection while ensuring a smooth customer experience.

Enhancing Security without Sacrificing Convenience

Dynamics 365 integrates security seamlessly into the customer journey, ensuring that safety measures do not hinder user experience:

- Transparent Security Measures: Security protocols operate in the background, offering protection without interrupting customer interactions.

- Streamlined Authentication Processes: Advanced authentication methods, such as biometrics and two-factor authentication, provide robust security while remaining user-friendly.

Real-Life Applications: Dynamics 365 Fraud Protection Collaboration with American Express

Challenge: Online retailers frequently encounter challenges with fraudulent transactions, particularly those that are card-not-present (CNP). These transactions, which occur without a physical card, are vulnerable to fraud, often leading to high rates of false positives. False positives can disrupt genuine customer purchases, resulting in dissatisfaction and loss of revenue for merchants.

Solution: Microsoft teamed up with American Express to address these challenges using Dynamics 365 Fraud Protection. This collaboration aimed to refine the accuracy of detecting fraudulent transactions by enhancing the communication between merchants and card issuers.

Implementation: The partnership leveraged Microsoft’s AI capabilities to assess transaction risks more accurately. Dynamics 365 Fraud Protection, equipped with advanced AI, analyzed transactions to provide a risk assessment score. This score was then shared with American Express through their Enhanced Authorization solution, allowing for a more comprehensive risk assessment from the card issuer’s perspective.

Outcome: The integration of these technologies demonstrated a significant decrease in false positives for card-not-present transactions. Merchants reported an increase in transaction approval rates and a reduction in the number of legitimate transactions declined. This improvement not only protected revenue but also enhanced the customer shopping experience by reducing friction during the payment process.

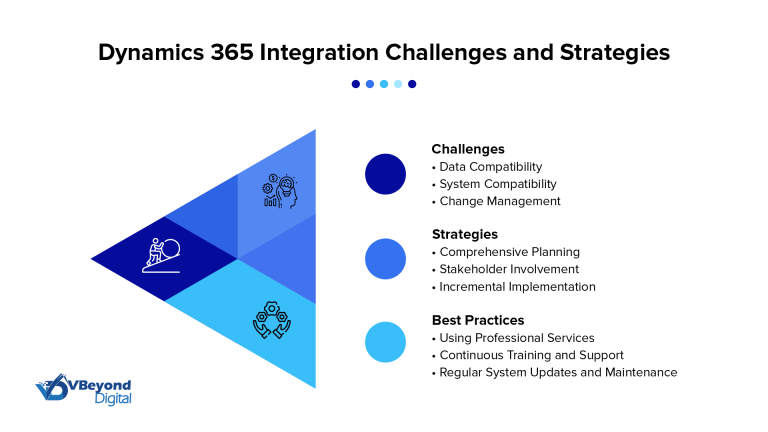

Dynamics 365 Integration Challenges and Strategies

Integrating Dynamics 365 into existing banking systems presents certain challenges, but with strategic planning and best practices, these can be effectively managed. The seamless integration of Dynamics 365 enables banks to leverage advanced fraud detection and client service automation without major disruptions.

Identifying Integration Challenges

Some common challenges include:

- Data Compatibility: Ensuring that existing banking data formats are compatible with Dynamics 365.

- System Compatibility: Aligning Dynamics 365 with the bank’s legacy systems to ensure smooth functionality.

- Change Management: Managing the transition for employees and customers as new systems and processes are implemented.

Effective Integration Strategies

To overcome these challenges, banks can adopt the following strategies:

- Comprehensive Planning: Engaging in detailed planning sessions to map out the integration process and anticipate potential issues.

- Stakeholder Involvement: Involving all key stakeholders early in the process to ensure their needs are met and to gain their support for the integration.

Incremental Implementation: Rolling out Dynamics 365 features in phases to minimize disruption and allow for adjustments based on feedback.

Best Practices for Seamless Integration

Some of the best practices include:

- Using Professional Services: Leveraging the expertise of professionals who specialize in Dynamics 365 integrations can help ensure a smoother transition.

- Continuous Training and Support: Providing ongoing training and support to staff to help them adapt to the new system.

- Regular System Updates and Maintenance: Keeping the system updated to adapt to new banking regulations and fraud detection techniques.

Regulatory Compliance and Ensuring Data Security

In the banking industry, adhering to stringent regulatory requirements while maintaining high standards of data security is paramount. Dynamics 365 facilitates compliance with these regulations and helps secure sensitive data, leveraging advanced technologies to protect both bank and customer information.

Meeting Regulatory Requirements

Dynamics 365 is designed to help banks comply with various financial regulations, including:

- GDPR: Ensuring that customer data is handled in compliance with General Data Protection Regulation standards.

- PCI DSS: Helping banks secure card data to meet Payment Card Industry Data Security Standard requirements.

- SOX: Assisting in compliance with the Sarbanes-Oxley Act for financial reporting.

Advanced Data Security Technologies

Dynamics 365 employs some of the most innovative of recent technologies to enhance data security:

- Confidential Computing: This technology allows data to be processed in a secure enclave, protecting it even when in use.

- End-to-End Encryption: Ensuring that all data transferred within and outside the bank is encrypted, preventing unauthorized access.

- Regular Security Audits: Dynamics 365 supports regular security audits to identify and rectify potential vulnerabilities.

Ensuring Data Privacy and Security

Dynamics 365 integrates robust mechanisms to safeguard data privacy and ensure security across all banking operations:

- Data Anonymization: Employing techniques to anonymize personal data, reducing the risk of identity theft.

- Role-Based Access Control (RBAC): Implementing strict access controls that ensure only authorized personnel can access sensitive information.

- Real-Time Monitoring: Utilizing AI-powered monitoring tools to detect and respond to security threats instantly.

Future Directions in Banking Fraud Detection and Client Services

As technology continues to evolve, Dynamics 365 is poised to remain at the forefront of advancements in banking fraud detection and client service automation. This section discusses the predicted trends and future capabilities of Dynamics 365 in tackling upcoming challenges in the banking sector.

Predictive Technologies and Machine Learning Enhancements

Future enhancements in Dynamics 365 are likely to focus on:

- Deepening Machine Learning Models: Further development of machine learning capabilities to provide even more precise fraud predictions and automate complex decision-making processes.

- Integrating Predictive Analytics: Expanding the use of predictive analytics in banking to foresee and mitigate potential fraud before it occurs.

Expanding AI Capabilities

As AI technologies advance, Dynamics 365 plans to:

- Enhance Real-Time Fraud Detection: Incorporate more sophisticated AI algorithms that can detect fraud in milliseconds, further reducing the window for fraudulent activities.

- Automate More Client Services: Extend automation to more complex and personalized banking services, enhancing customer experiences while reducing operational costs.

Collaborative and Secure Technologies

Looking forward, Dynamics 365 aims to:

- Foster Collaborative Ecosystems: Develop platforms that integrate various stakeholders, including banks, regulatory bodies, and technology partners, to create a more secure and efficient banking environment.

- Strengthen Data Security Measures: Implement newer technologies that provide even greater security, such as blockchain for transaction integrity and advanced cryptographic methods.

Conclusion

A banking enterprise environment built with Microsoft Dynamics 365 and Azure can be configured for precise fraud detection and customer service. By extracting the most value from AI and machine learning, strengthening real-time detection capabilities, and ensuring compliance with stringent regulatory standards, Dynamics 365 and Azure equip banks with all the necessary tools to secure their operations and improve customer satisfaction.

For banks looking to future-proof their operations and enhance customer engagement, Dynamics 365 offers a comprehensive and forward-looking solution. VBeyond Digital brings industry understanding and proven deployment expertise to support banking enterprises with digital transformation and system upgrade support.

Get in touch with us for a consultation.