Dynamics 365 Finance & Operations vs Business Central: Which ERP is Best for You?

Section

Table of Contents

- The CFO Mandate: From Reporting Hub to Intelligence Engine

- Why Oracle Fusion Cloud ERP is a Strategic Platform for Finance

- Designing A Target-State Finance Operating Model with Oracle Fusion Cloud ERP

- Integration, Data and Analytics: Making Oracle Fusion the Core Finance System of Record

- Conclusion: A Practical Path to a Resilient, Data-Led Finance Function

- FAQs (Frequently Asked Question)

- Oracle fusion cloud ERP can run finance as a governed system of record, not fragmented tools.

- Pair Oracle Cloud Financials with integration, data governance, and release management to improve auditability and speed.

- Build a Finance Operating Model that supports quarterly updates without disrupting close, controls, or reporting.

- Use ERP Implementation Services to cut manual journals, reduce reconciliation effort, and improve decision-cycle visibility.

Finance teams are expected to tighten control and reduce risk while also giving business leaders faster guidance on margin, cash, and investment tradeoffs. For CIOs, CTOs, and IT Directors, this changes the job from “run finance systems reliably” to “run finance as a decision engine with audit-grade data.”

Why are finance teams under pressure?

Several forces are converging:

- Volatility and margin pressure are pushing finance leaders to model scenarios more often and with more granular inputs.

- Regulatory and audit expectations are increasing the demand for traceable policies, approvals, and data lineage.

- Boards and investors expect finance to provide timely guidance, not only month-end reporting.

The outcome many CFOs are driving toward is clear: fewer manual controls, faster close, better visibility into cash and working capital, and stronger confidence in reported numbers.

Why traditional ERP is holding finance back

In many enterprises, the constraints are not the finance team’s skills. They are structural:

- Fragmented ledgers and subledgers across business units or acquired entities.

- Manual reconciliations and journal entries to correct issues created upstream.

- Batch reporting cycles that delay visibility into revenue, cost, and cash positions.

- Upgrade projects that consume budget and slow the adoption of new capabilities.

These patterns make Automated Financial Reporting harder to trust and harder to scale, especially during legacy to cloud migration.

Where does Oracle Fusion Cloud ERP fit for finance leaders?

Oracle positions Oracle Fusion Cloud ERP as a cloud ERP suite with automatic updates and built-in AI capabilities for ERP and finance activities. Oracle also describes Oracle Cloud Financials as a financial management platform covering key finance processes such as payables, receivables, fixed assets, expenses, and reporting.

For IT planning, the quarterly update model is central. Oracle documentation and release guidance describe a quarterly update schedule for Oracle Fusion Cloud applications.

For IT planning, the quarterly update model is central. Oracle documentation and release guidance describe a quarterly update schedule for Oracle Fusion Cloud applications.

What this blog will cover

This ERP Implementation blog is written for technology leaders supporting the office of the CFO. It focuses on what you need to design and run:

- A target Finance Operating Model around Oracle Fusion Finance.

- Integration patterns that treat Oracle fusion cloud ERP as the financial system of record.

- Data governance and analytics patterns that support audit, performance, and decision cycles.

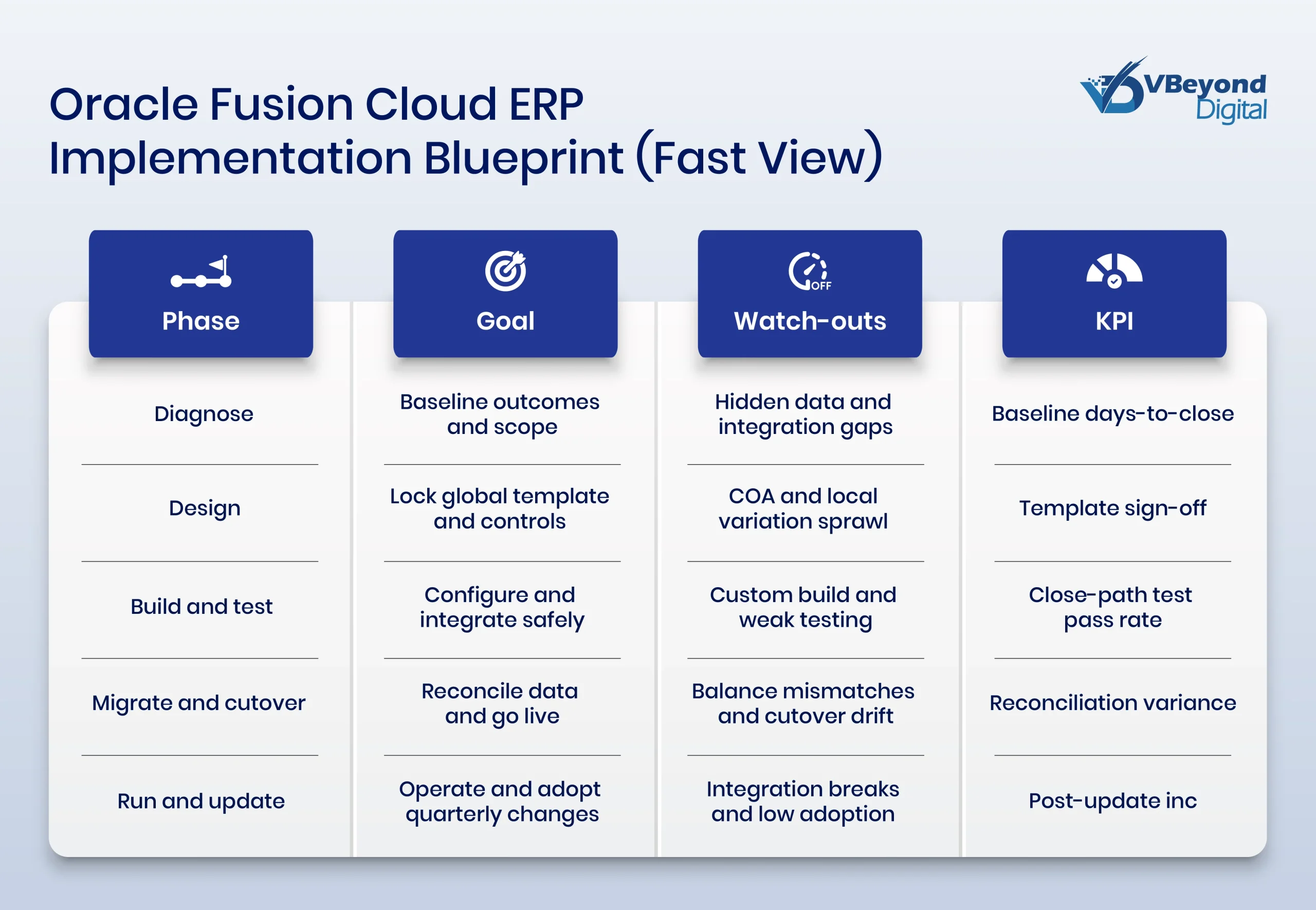

- A practical ERP Implementation Services blueprint with risks and KPIs.

Start Your Oracle Fusion Roadmap.

The CFO Mandate: From Reporting Hub to Intelligence Engine

Finance leaders are being measured less on the quality of month–end reporting and more on how quickly they can explain what is happening in the business, why it is happening, and what to do next. For technology leaders, this means the finance platform must support faster decision cycles while still meeting audit and regulatory needs.

How the CFO role has shifted

The CFO remit increasingly includes enterprise decision support and governance, not only controllership.

What this enables the business to do:

- Make faster calls on pricing, discounting, and cost actions when margin changes.

- Respond sooner to cash signals like collections risk, supplier exposure, or inventory buildup.

- Run planning cycles more often with fewer data disputes and fewer spreadsheet workarounds.

PwC notes rising expectations for faster forecasts, sharper insights, and tighter controls, even as finance teams deal with fragmented data and budget pressure.

From an operating standpoint, many CFO organizations are working toward forms of continuous close, where reconciliations and validations happen through the period so that the close is less of a single event. EY describes continuous close and reporting on-demand as practical shifts driven by automation, AI, and cloud platforms.

What boards and CEOs now expect from finance technology

Boards want finance to produce answers quickly, with evidence behind the numbers. The requirement is not “more dashboards.” It is traceable data, consistent definitions, and controls that do not slow the business.

Common expectations include:

- Visibility into revenue, margin, and cash at shorter intervals than the month-end pack.

- Scenario analysis that can be refreshed quickly when assumptions change.

- Control and audit evidence that is clear enough for internal audit and external auditors, without manual evidence collection.

Why Oracle Fusion Cloud ERP is a Strategic Platform for Finance

For technology leaders, a strategic ERP cloud platform is valuable when it does three things at once:

1. It runs core finance processes with standard controls and predictable change.

2. It exposes clean integration surfaces so finance data can move to planning, analytics, and industry systems.

3. It supports AI in Finance use cases that reduce manual effort and improve signal quality, without creating a parallel shadow stack.

Core capabilities relevant to the CFO agenda

Oracle Cloud Financials is described by Oracle as a financial platform that connects and automates financial management processes, including payables, receivables, fixed assets, expenses, and reporting. In Oracle’s own Financials documentation, Oracle Financials Cloud is listed as including General Ledger, Intercompany Accounting, Payables, Receivables, Payments, Cash Management, Tax, Expenses, and Assets.

From an enterprise architecture point of view, this matters because it allows you to reduce “finance by interface” where each function runs on a different system and finance teams spend cycles reconciling between tools.

In practical terms, Oracle Fusion Finance programs typically focus first on a small set of process outcomes:

- General Ledger and close control: Consistent posting rules, period control, and design that reduce manual journal volume.

- Procure to Pay and Payables: Invoice capture, validations, approvals, payments, and supplier spend visibility.

- Order to Cash and Receivables: Billing, receipts, dispute handling, and collections of visibility.

- Fixed Assets and Expenses: Asset Lifecycle Accounting and employee expenses tied to policy controls.

Embedded AI and automation that targets finance work, not demos

Oracle publishes a catalog of AI capabilities across Oracle Fusion Cloud Applications, including finance use cases such as intelligent document recognition for supplier invoices, transaction matching for reconciliations, predictive cash forecasting, and automated narratives for management reporting.

Oracle also documents ERP features with AI and provides feature level references across finance areas. One concrete example is “intelligent defaulting of account combination,” where Oracle documentation describes AI and machine learning algorithms providing default distribution combinations for accounts payable invoice lines based on historical patterns.

SaaS delivery model and what it means for IT planning

Oracle Fusion Cloud Applications follow a quarterly update schedule, and Oracle provides a readiness site to review new features and updates by product and functional area.

For IT planning, quarterly updates change the operating model:

- Regression testing becomes a recurring capability, not a one-time project phase.

- Feature adoption becomes a controlled pipeline with business approval and training.

- Security and controls review becomes part of release governance.

This is where Cloud ERP Services must include release management design, test automation strategy, and a stable path from preview environments to production.

Outcomes for finance and technology leaders

When Oracle fusion cloud ERP is implemented with a clear Finance Operating Model, disciplined data governance, and stable integrations, it supports outcomes that boards tend to ask for:

- Fewer manual reconciliations and fewer manual journal adjustments because posting logic and validations are enforced earlier in the process.

- Faster reporting cycles because finance teams spend less time disputing data definitions and tracing source transactions.

- Stronger audit evidence through configured auditing, controlled access design, and documented policy workflows.

- A cleaner base for AI in Finance because invoice, reconciliation, and cash forecasting features rely on structured transactional history.

Designing A Target-State Finance Operating Model with Oracle Fusion Cloud ERP

A target-state Finance Operating Model is what turns Oracle fusion cloud ERP into a stable finance platform rather than a collection of modules. For CIOs, CTOs, and IT Directors, the operating model is where governance, role design, integration ownership, and release control meet day-to-day execution.

The business outcome you want is consistent finance execution across regions and business units, with controlled variance where regulation or statutory reporting requires it. That is how Oracle Fusion Finance supports faster decision cycles without creating control gaps.

Principles for a durable finance design

1) Global standards with controlled local variation

Start with a global finance template that defines the common elements:

- Chart of accounts structure and segment standards.

- Accounting policies, subledger accounting rules, and period close procedures.

- Core workflows for approvals, tolerances, and exception handling.

- Standard reporting definitions for management and statutory views.

Then define local extensions as explicit variants. The goal is not to force one process everywhere. The goal is to prevent every region from inventing a new version of “the same” process.

2) Strong central governance for chart of accounts and master data

In Oracle Cloud Financials, the chart of accounts is built around segments and value sets, and Oracle documentation describes how you define segment attributes and labels (such as natural account and balancing). This is one of the highest impact design areas because it sets the structure for Automated Financial Reporting and for management reporting by segment, product, or region.

Governance practices that technology leaders can operationalize:

- A named COA owner and design authority (finance led, with IT architecture input).

- A controlled process for new values and hierarchy changes, including approvals and audit trail requirements.

- Master data alignment rules for supplier, customer, product, project, and legal entity structures.

3) Clear boundaries between configuration and extensions

A clean operating model defines what must be handled inside Oracle fusion cloud ERP configuration versus what belongs in external services.

A practical decision rule:

- Configure in Oracle Fusion Finance when it is policy, workflow, or accounting logic.

- Extend only when the requirement is outside delivered capabilities, and the business case is clear.

- Keep integration logic and orchestration in an integration layer, so quarterly updates do not break point-to-point dependencies.

Process views that matter mostProcess views that matter most

A CFO-grade operating model is built around a few end-to-end flows. Oracle Fusion Finance supports these flows through Oracle Cloud Financials modules and common process features.

1. Record to Report (R2R)

What it enables:

- Faster, more repeatable close with fewer manual adjustments.

- Better traceability for journal sources and period activities.

Operating model decisions to make early:

- Close calendar by entity and region, with ownership of each close task.

- Journal entry policy: what is automated, what is allowed manually, what requires review.

- Reconciliation ownership and escalation rules, including how exceptions are tracked.

2. Procure to Pay (P2P)

What it enables:

- Clearer spend controls and approval routing.

- Better visibility into liabilities and payment timing.

Key design points:

- Supplier onboarding controls and who owns supplier master data.

- Invoice exception management model (what is fixed in business operations versus finance).

- Approval chains and tolerance rules tied to policy.

3. Order to Cash (O2C)

What it enables:

- Faster cash collection visibility and dispute governance.

- More reliable aging, credit, and collections of reporting.

Key design points:

- Customer master data ownership and alignment with CRM.

- Dispute lifecycle controls and handoffs between sales, operations, and finance.

- Revenue and billing integration strategy if order capture is external.

4. Project to Cash (P2C)

What it enables:

- Better project cost visibility, capitalization, and billing alignment.

- Stronger margin control on delivery work and internal projects.

Key design points:

- Project structure governance and who can create or change project attributes.

- Cost capture rules, approvals, and integration with time or delivery systems.

- Billing and revenue interfaces if project execution systems are separate.

5. Treasury and cash management

What it enables:

- Better cash position reporting and cash forecast inputs.

- Cleaner controls around bank accounts, signatories, and payments.

Key design points:

- Bank account governance and segregation of duties.

- Payment processing ownership and escalation.

- Cash positioning data feeds and reconciliation responsibilities.

Structuring the finance organization around the platform

Many enterprises organize transaction processing as shared services, with a center of excellence to own standards, release readiness, and process design. Oracle documentation describes Shared Service Centers as a way to define service relationships between business units and provides guidelines that reference business unit security for shared services personnel processing transactions for client business units.

A workable structure for Oracle fusion cloud ERP programs:

- Shared services run routine processing (AP, expenses, cash application, some close activities).

- Process owners and CoE own standards, templates, controls, and feature adoption decisions.

- Business partnering teams focus on analysis and decision support, using consistent data definitions from Oracle Cloud Financials.

For IT and finance operations, shared accountability matters:

- Finance owns policies, close rules, and process outcomes.

- IT owns platform reliability, environment management, integration health, and security operations.

- Data governance is joint ownership, because reference data design affects every module and every downstream report.

Designing for continuous change with quarterly updates

Oracle Fusion Cloud Applications follow a quarterly update schedule, and Oracle’s readiness documentation describes “optional uptake” where some features arrive enabled while others require opt-in actions.

A release operating model should include:

- A readiness review cycle tied to Oracle’s quarterly schedule.

- Impact assessment for finance processes, integrations, and reporting.

- Regression testing plan across critical flows (R2R, P2P, O2C, P2C).

- A controlled approach to opt-in features, with business sign-off and training plans.

For configuration portability across environments, Oracle documentation describes configuration packages in Setup and Maintenance, including exporting setup data tied to an implementation project and importing via Manage Configuration Packages.

Outcome focus

A well-built Finance Operating Model on Oracle fusion cloud ERP supports:

- A reliable global view of P&L and balance sheet by segment, product, and region.

- Repeatable patterns for new entities from acquisition activity during legacy to cloud migration.

- More credible Automated Financial Reporting because master data, policies, and workflows are governed, not improvised.

Integration, Data and Analytics: Making Oracle Fusion the Core Finance System of Record

If Oracle fusion cloud ERP is going to power decision cycles, it must be treated as the system of record for finance transactions and reference data, with controlled paths for data to move to planning, customer systems, and enterprise analytics. The outcome is simple to describe and hard to deliver: one set of numbers that business leaders trust, backed by traceable source transactions and stable integrations.

Integration strategy for CIOs and IT Directors

A practical integration strategy for Oracle Fusion Finance starts by classifying every interface into one of three types:

- System of record flows: Where Oracle fusion cloud ERP owns the official finance transaction or master record.

- Operational handoffs: Where upstream systems (CRM, commerce, industry platforms) trigger finance events such as billing, revenue, or project cost.

- Analytical distribution: Where finance data is extracted to analytics, planning, and regulatory reporting environments.

Oracle provides REST APIs for Oracle Cloud Financials, enabling teams to “view and manage data stored in Oracle Financials Cloud,” with REST resources and endpoint documentation. This supports API-first integration for many common use cases such as querying invoices or posting objects via supported resources.

You still need a bulk pattern for high-volume loads and corrections. Oracle’s File-Based Data Import (FBDI) guides describe how to use file-based processes to import or update data from external applications into Oracle Financials Cloud. In practice, ERP Implementation Services often use a mix of REST APIs for event-driven needs and FBDI for bulk loads.

Typical integration patterns with CRM, industry platforms, EPM, and data platforms

Technology leaders typically choose from these patterns based on latency, volume, and control requirements:

1. CRM to Oracle Cloud Financials (quote to cash)

- Common goal: Billing and receivables reflect the commercial system of record without manual re-entry.

- Key design points: Customer master alignment, billing event definitions, dispute workflow ownership.

2. Industry platforms to Oracle Fusion Cloud ERP (usage, claims, logistics, or subscription events)

- Common goal: Subledger entries and revenue events match operational truth.

- Key design points: Event payload design, idempotency, error handling, and audit evidence for replays.

3. EPM and planning integration (actuals to plan and forecast cycles)

- Common goal: Consistent actuals, at the right grain, delivered on a dependable schedule.

- Key design points: Mapping governance, close calendar alignment, and reconciliation rules between finance actuals and planning cubes.

4. Enterprise data lake or warehouse integration

- Common goal: Cross-domain analytics that joins finance with product, customer, and operational data.

- Key design points: Extraction method, refresh frequency, row-level security strategy, and lineage.

API-first and event-based options for near real-time data sharing

Oracle supports multiple integration approaches that can be combined:

- REST APIs for Oracle Cloud Financials: For transactional read and write patterns where REST resources exist.

- Business events via Oracle Integration: For cases where an event subscription fits the requirement. Oracle documentation for public business events explains that integration developers can subscribe to public events from Oracle Integration Cloud using the Oracle ERP Cloud Adapter and then use the payload for event handlers.

Availability varies by module and event catalog; so, event coverage should be validated during design.

- Bulk import with FBDI: When large datasets must be loaded to interface tables and then application tables.

- Bulk extract with BICC: When exporting large volumes for downstream warehouses or third-party apps. Oracle documentation describes Business Intelligence Cloud Connector (BICC) as a way to extract data in bulk and load it into external storage areas—it is described as a preferred option for bulk export from Oracle Fusion Cloud Applications.

Analytics patterns on Oracle Fusion Cloud ERP data

Credible analytics approach normally uses multiple reporting methods, each aligned to a purpose:

- Operational reporting for process control

Oracle Transactional Business Intelligence (OTBI) is positioned as the self-service analytics layer for Fusion transactional data, while Oracle documentation provides OTBI guidance for creating reports and dashboards.

- Pixel-perfect and scheduled documents

Oracle’s Financials reporting guidance describes Analytics Publisher as the part of OTBI used for reports, including creation, templates, and administration.

- Financial statement style reporting and Excel-connected workflows

Oracle documentation describes the Financial Reporting Center for reviewing and presenting financial reports and notes that Smart View installation is performed by end users.

- Prebuilt analytics models across Fusion application data

Oracle Fusion Analytics documentation states you gain a ready-to-use, single analytics data model for Oracle Fusion Cloud Applications data that is extensible to include external data.

Using Oracle Fusion Cloud ERP with enterprise data platforms

For cross-domain analytics, teams commonly extract finance data and join it with customer usage, product telemetry, fulfillment, and support data. BICC supports bulk extraction to external storage, which is a common bridge into enterprise warehouse patterns.

Key technical decisions that reduce risk:

- Define a canonical financial grain for analytics (invoice line, journal line, subledger distribution).

- Store keys that support trace-back from KPI to transaction.

- Apply role-based security rules consistently between Oracle Fusion Finance and the analytics layer.

Outcomes for the business

When Oracle fusion cloud ERP is treated as the finance system of record, with clear integration patterns, the business gets:

- Higher confidence in reported numbers because definitions and source systems are consistent.

- Faster responses to board and audit questions because trace-back paths are built into the data design.

- Better decision cycles for cash, margin, and working capital because actuals arrive faster and exceptions are visible sooner.

Conclusion: A Practical Path to a Resilient, Data-Led Finance Function

Oracle fusion cloud ERP can be a strong anchor for finance when it is treated as a governed platform that runs core transactions, exposes trusted data for analytics and planning, and supports controlled change through quarterly updates. Oracle Cloud Financials is positioned as a financial management platform that covers processes such as payables, receivables, fixed assets, expenses, and reporting. Oracle’s Financials Cloud documentation also lists the suite components, including General Ledger, Payables, Receivables, Payments, Cash Management, Expenses, and Assets.

A key part of the strategic ERP cloud model is the operating rhythm. Oracle Fusion Cloud Applications follow a quarterly update schedule, which changes how IT and finance plan testing, feature adoption, and readiness.

Cloud ERP Services succeed when they connect platform choices to measurable finance outcomes. From strategy to build, VBeyond Digital helps tech leaders turn Oracle fusion cloud ERP into a run-ready finance foundation. Through ERP Implementation Guide discipline and ERP Implementation Services that cover operating model, integration engineering, data governance, and release readiness.

FAQs (Frequently Asked Question)

Oracle fusion cloud ERP is a SaaS ERP suite that includes Oracle Cloud Financials. It matters because it standardizes core finance processes, supports controlled access and auditing, and provides APIs and automation that reduce manual work.

By centralizing finance transactions in Oracle Fusion Finance, reducing reconciliation delays, and enabling faster data extraction through APIs and analytics tooling. With cleaner master data and controls, dashboards and close metrics reflect operational reality sooner.

Cloud ERP reduces large upgrade cycles, supports frequent product updates, and standardizes processes. It also improves scalability and supports modern integration patterns, while strengthening governance through centralized security, auditing, and consistent data definitions.

These are Record to Report, Procure to Pay, Order to Cash, Expenses, Fixed Assets, Cash Management, and intercompany accounting. It can also automate approvals, validations, and selected AI-supported tasks like invoice processing and account coding suggestions.

It can prepare by baselining KPIs, defining a global template and data governance, inventorying integrations, and planning migration with reconciliation controls. It also needs to set joint CFO-CIO-CTO governance, build a quarterly release testing approach, and choose ERP Implementation Services partners with strong integration and Financials depth.