Transform Your Back Office: The Top 5 Business Benefits of Adopting Oracle Cloud ERP

Section

Table of Contents

- Benefit 1. A Single Source of Financial and Operational Truth

- Benefit 2. Real-Time Visibility That Supports Action Inside the Quarter

- Benefit 3. Automation That Cuts Manual Finance Effort and Lowers Processing Cost

- Benefit 4. Capacity and Reach That Grow with the Business

- Benefit 5. Continuous Improvement Without Heavy IT Burden

- Conclusion: Your Back Office Can Either Slow Growth or Support It

- FAQs (Frequently Asked Question)

- See why Oracle Cloud ERP transforms back-office finance with five measurable business benefits.

- Learn how a single data model and OTBI deliver real-time, in-quarter financial and operational visibility.

- Explore built-in automation, IDR, PO matching, close monitoring that reduce manual work, errors, and cycle times.

- Understand scalable SaaS updates and VBeyond Digital’s implementation approach for modernization, compliance, and faster financial close.

CIOs and CFOs are asking for finance and operations to guide the business inside the quarter, not after it. That is hard to do when core processes still sit in spreadsheets and aging finance stacks.

Manual reconciliation is another structural weakness. When reconciliations happen in Excel and email, teams miss exceptions, version control is weak, and audit trails are fragmented. This increases the chance that timing mismatches, missed deposits, or duplicate entries surface only after period close. It also concentrates operational knowledge in a few people, which raises resilience risk.

Why are leaders acting now?

- Data you can act on during the period. Legacy finance systems and spreadsheet-centric reporting deliver meaningful insight only after closing. This delays course correction and cash decisions.

- Auditability and controls. Disconnected files lack consistent policy enforcement, lineage, and logging, which strains audit readiness and internal control testing.

- Scale and agility. Traditional ERP and custom point tools require projects and hardware to support new entities or regions, which slows expansion. Current Cloud ERP solutions shift capacity and updates to the vendor.

- Innovation cadence. Modern suites such as Oracle Cloud ERP deliver quarterly product updates that add automation, security, and analytics without large upgrade programs. This reduces technical debt while improving capability.

Why is Oracle Cloud ERP the platform many enterprises choose?

Oracle Cloud ERP centralizes finance, procurement, projects, and supply chains on a single data model, then adds AI and automation services that reduce manual effort. Examples include AP invoice capture and matching, exception handling, and account reconciliation assistance. Oracle publishes new capabilities on a quarterly schedule and has introduced AI agents to automate multi-channel invoice processing and policy checks, which helps reduce cycle time and error rates. For CIOs and CFOs, this means a single version of the truth, fewer clerical tasks, and real-time financial insights that support action before quarter end.

Benefit 1. A Single Source of Financial and Operational Truth

Modern finance and operations leaders need consistent, actionable data available within the quarter. Oracle Cloud ERP provides consistency by running core processes on one suite that shares a common data foundation. Financials, procurement, projects, and related functions sit on Oracle Fusion Cloud Applications, which include embedded reporting on transactional data and prebuilt analytics that reflect the same records leaders see in daily operations. This reduces reconciliation work and gives decision makers a shared set of facts.

Issues in the current model

- Finance, procurement, and operations often maintain separate systems with their own coding and reporting logic. Numbers are reconciled after the fact, which delays decisions and raises error risk.

- Supplier data, commitments, receipts, and invoices are scattered, which makes it hard to answer basic questions such as open exposure by vendor or committed spend by project.

- Project costs, contract billing, and revenue plans are tracked in tools that are not tightly aligned with the general ledger. This leads to mismatched results at month end.

Start Oracle Cloud ERP now

- Common operational record across finance and operations –

Oracle Fusion Cloud Financials centralizes payables, receivables, fixed assets, expenses, and reporting. The application family provides consistent tables and subject areas for analysis, enabling finance teams to move from transaction to metric without exporting and reshaping data in separate tools. Oracle publishes module level tables and views and provides a guide for common features across Financials and Project Management. This supports a single information model rather than disconnected data stores. - Live reporting on transactional data –

Oracle Transactional Business Intelligence (OTBI) is embedded in the suite. OTBI subject areas draw from active transactional tables, ensuring that analyses and dashboards reflect current entries rather than overnight snapshots. Oracle’s documentation states that OTBI is used to analyze your business and take action with embedded and ad hoc analysis on transactional data, and that OTBI reports are based on real-time transactional data in Fusion applications. - Prebuilt analytics across finance, procurement, and projects –

Oracle Fusion ERP Analytics extends reporting with prebuilt metrics that span profitability drivers, working capital, and spending. Designed for Oracle Fusion Cloud ERP, it aligns with the same chart of accounts, suppliers, and project structures that support daily operations. - Integrated procurement to pay controls –

Oracle supports two-way, three-way, and four-way invoice matching that ties invoices to purchase orders, receipts, and acceptance, which anchors AP results to purchasing activity. This reduces manual reconciliation and gives finance a consistent view of obligations. Oracle Docs - Projects tied to financial outcomes –

Oracle’s Project Management capabilities connect with Financial Management and Procurement to manage project cost, contract billing, and revenue on the same platform. Oracle also documents integration patterns for projects data with financials and planning. This alignment helps project owners and controllers reference the same numbers when reviewing margins by project or program.

Benefit 2. Real-Time Visibility That Supports Action Inside the Quarter

Finance and operations teams need numbers that move at the speed of the business. Waiting for a batch to refresh or a period close leaves leaders reacting after cash has already gone out the door. Oracle Cloud ERP addresses this with live reporting on transactional data, configurable monitors, and prebuilt analytics for finance, procurement, projects, and supply chain. The result is real-time financial insights that guide in-quarter decisions rather than after-the-fact commentary. This section shows how that works using documented Oracle capabilities and where Oracle Cloud ERP implementation choices matter.

Issues in the current model

- Period-close dependency: Meaningful performance views tend to arrive only after journals are posted, and reconciliations finish. By then, budget variance and margin erosion are already locked in for the period.

- Fragmented metrics: Procurement, projects, and finance reports from different tools, leads to inconsistent filters, timing, and definitions, hence teams debate numbers instead of acting on them.

- Manual exception hunting: Finance analysts scan exports for anomalies and late supplier performance. This is slow and misses issues that occur mid-month.

- Shallow supplier visibility: Without an integrated supplier and spend analytics, it is difficult to see delivery slippage, contract leakage, and exposure by category in time to course correct.

How Oracle Cloud ERP addresses this

1) Live reporting directly on transactions –

Oracle Transactional Business Intelligence is embedded in Fusion Applications and is designed for real-time analysis of operational subject areas. OTBI queries read from the same application objects that users post during the day, which means dashboards reflect current activity rather than a stale snapshot. Oracle’s product documentation describes OTBI as a real-time, self-service reporting solution for Fusion Cloud Applications.

2) Finance monitors and in-context drill –

Within Financials, the Financial Reporting Center includes the Account Monitor and Account Inspector. These features monitor and track key account balances in real time and allow ad hoc inquiry from account groups, with drill to transaction details. Teams can set thresholds, watchlist for critical balances, and investigate changes without exporting data.

3) Procurement analytics tied to supplier performance –

Oracle Fusion Cloud Procurement delivers analytics and reports within the application. Procurement users can access analyses, dashboards, and reports from the Reports and Analytics work area, while Oracle’s product page highlights visibility into performance against price, service, and delivery obligations. For organizations standardizing Cloud ERP solutions, this creates a single view of supplier performance and contract compliance.

4) Prebuilt cross-domain analytics for finance, procurement, and projects –

Oracle Fusion ERP Analytics is a prebuilt analytics solution for Oracle Cloud ERP. It provides KPI frameworks for profitability drivers, working capital, spend, and project health, all aligned with the same data model as the operational suite. Oracle’s materials show packaged content that helps leaders see agreement leakage, negotiated spend percentage, top suppliers, and addressable spend, as well as visual insights for project revenue and billing. These assets reduce time to value and support an outcome-led reporting model.

5) Automated anomaly and exception detection in key flows –

Oracle documents AI-based anomaly detection capabilities that flag outliers faster than rules alone. In the context of ERP, Oracle highlights expense anomalies and policy exceptions in packaged analytics; also, broader anomaly detection services are available on Oracle Cloud Infrastructure for time-series signals when required. Combined with OTBI and monitors, these capabilities help teams address irregular spending or unexpected activity during the period.

6) Operational alerts for manufacturing and supply planning –

For supply chain scenarios, Oracle’s production monitoring processes can retrieve alerts in real time for IoT-enabled resources and surface them in planning work areas. Finance and operations leaders gain earlier visibility into late production or throughput issues that may impact revenue and cost.

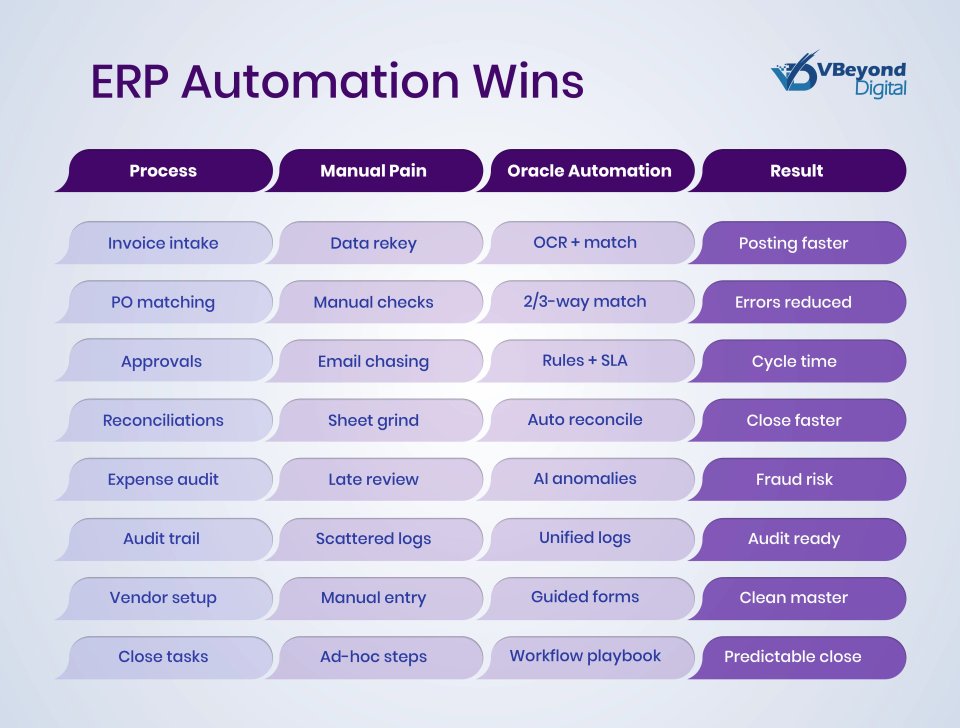

Benefit 3. Automation That Cuts Manual Finance Effort and Lowers Processing Cost

Leaders want finance capacity redirected from clerical work to guidance. Oracle Cloud ERP supports this shift with native services that reduce manual entry, apply policy rules at the point of action, and keep period close moving. The following capabilities are documented features rather than assumptions.

What slows teams today?

- Invoice intake by hand. AP teams key invoice headers and lines, then chase POs and receipts to validate amounts.

- Rules and approvals outside the system. Email-based approvals add latency and weaken traceability.

- Close coordination by spreadsheet. Status is hard to track across subledgers and ledgers, so period close stalls.

- Bank reconciliation after the fact. Matching bank statements to cash transactions takes days when done manually.

- Expense policy checks as a late audit. Review happens after reimbursement, which increases rework.

How Oracle Cloud ERP removes manual effort

- Invoice capture with Intelligent Document Recognition. Oracle‘s Intelligent Document Recognition (IDR) is a fully integrated invoice recognition solution that extracts invoice information from emailed documents and creates invoices in Payables. IDR is part of Oracle Cloud ERP and supports the invoice lifecycle inside Payables.

- PO and receipt matching in Payables. Payables support two-way, three-way, and four-way matches (invoice to PO; invoice to PO and receipt; invoice to PO, receipt, and acceptance). This ties AP validation to purchasing activity and reduces manual checks.

- Configurable approvals on Expenses. Oracle Fusion Expenses uses BPM-based approval rules that administrators configure for approving routing and conditions. This brings approval logic into the suite with auditable rules rather than ad hoc email chains.

- Policy enforcement and audit selection in Expenses. Implementers can define receipt requirements, corporate card usage rules, and amount thresholds. Expenses also support audit selection rules, including random sampling and targeting reports above a specified amount or for people on an audit list.

- Close status and task coordination in General Ledger. Close Monitor provides period close status across ledgers and applications in a hierarchical ledger set view, with visibility of where work is pending. This replaces manual status spreadsheets and helps controllers keep the close on track.

- Automatic bank reconciliation. Cash Management includes automatic reconciliation based on rule sets, which matches bank statement lines to system transactions and is intended for high volumes. File-based import is available for bank statements as part of Financials FBDI

Oracle has embedded AI-driven features directly into Oracle Fusion Cloud ERP and Oracle Cloud ERP Services. Oracle publishes that many of these capabilities, including Intelligent Document Recognition in Accounts Payable, predictive account coding, and digital assistants, can be activated without buying separate third-party tooling. These AI features exist to reduce manual AP touch time, support cash control, and speed financial close.

Benefit 4. Capacity and Reach That Grow with the Business

Global growth exposes the limits of on-premises stacks and point tools. Adding a country, a business unit, or a high-volume channel should not require hardware purchases or lengthy replatform efforts. Oracle Cloud ERP is delivered as SaaS on Oracle Cloud Infrastructure. Capacity and coverage scale through the service, and enterprise structures support multi-entity, multi-ledger, and multi-currency operations in one global footprint. This section summarizes the specific capabilities that make expansion practical for CIOs and CFOs.

What slows expansion in legacy models?

- New regions often require new instances. Infrastructure procurement and environment buildouts delay go-live.

- Compliance requirements vary by country. Siloed ledgers and bespoke local systems multiply reconciliation and support cost.

- Volume spikes during quarter end or seasonal peaks overwhelm fixed capacity. Performance suffers just when finance need’s reliability.

- Adding a functional area such as procurement or project accounting becomes a separate program, which fragments data and roles.

VBeyond Digital helps you get Oracle Fusion Cloud ERP live, stable, and continuously improving without guesswork. We build the value case, stand up the operating model, map and migrate critical data, design integration through Oracle Integration Cloud, and run the quarterly update rhythm that Oracle requires so production stays stable and auditable.

How Oracle Cloud ERP supports scale and reach

- Global enterprise structures in a single cloud footprint: Oracle documents that enterprise structures can model legal entities, ledgers, business units, and reporting currencies to meet local and corporate requirements. Each accounting setup has a primary ledger and can include secondary ledgers and reporting currencies. Business units post to a primary ledger, which provides consistent control while supporting local operations. These design choices let large organizations run multiple entities and report regimes on one application footprint.

- Multi-currency, translation, and revaluation: Global finance requires accurate currency handling. Oracle Financials supports reporting currencies and translation processes that restate balances from ledger currency to reporting currency. Revaluation processes adjust foreign currency balances for rate changes, with journals posted to unrealized gain or loss accounts. These are standard, documented processes that reduce manual work when operating across currencies.

- Scale across countries without multiple implementations: Oracle’s global catalog reference notes that the application supports unlimited accounting representations and statutory reporting needs in a single global instance. This allows customers to adapt software to specific regions without creating multiple parallel implementations, which reduces duplication of environments and the overhead of cross-instance reconciliation.

- Elastic capacity on Oracle Cloud Infrastructure: Oracle Cloud Infrastructure (OCI) provides guidance for horizontal and vertical scaling and publishes service-level commitments for availability, performance, and manageability. High availability references describe fault domains, availability domains, and disaster recovery patterns that avoid single points of failure. For ERP leaders, this means capacity and resilience are addressed as part of the cloud platform rather than local hardware projects.

- Regional presence and subscription control

When enterprises expand to new markets, OCI supports subscription to additional regions through the console. This helps align application residency and latency with business needs while maintaining a unified global ERP service. - Add functional scope as the business evolves

Oracle positions Fusion Cloud ERP as a suite that covers financials, procurement, projects, and more. Teams can introduce modules such as Procurement using the product’s implementation guides and integration of playbooks. This staged approach allows scope growth without building a second ERP stack.

Benefit 5. Continuous Improvement Without Heavy IT Burden

IT leaders want predictable progress without another disruptive upgrade cycle. Oracle Cloud ERP is delivered as SaaS, and the application suite follows a quarterly update cadence with clear readiness guidance, controlled test windows, and documented feature rollouts. Oracle manages infrastructure, application patching, and platform security as part of the service. Your teams focus on business design, testing, and adoption rather than patch orchestration and hardware work.

Issues in the current model

- On-premises ERP upgrades require months of planning, weekend cutovers, and recovery windows. Risk accumulates when upgrades are deferred.

- Security patching competes with operational priorities, which creates gaps that auditors and regulators flag.

- New capability often requires side projects, point integrations, or manual workarounds that add technical debt.

- Release notes and regression scope are hard to track across customizations, which slows the path from feature to outcome.

How Oracle Cloud ERP changes the operating model

- Quarterly update cadence with readiness content

Oracle publishes product specific “What’s New” documentation for each quarterly update. The Cloud Applications Readiness site allows teams to review features by product area and release, including Oracle Fusion Cloud Financials and other ERP modules. For the current cycle, the readiness pages enumerate features for Update 25D and provide planning notes. - Test-first update flow across environments

Oracle describes a two-step cadence. A non-production environment receives the update first. There is then a gap, typically two weeks before the production environment is updated. This window allows customers to validate critical business flows and raise issues with Oracle Support before production is updated. - Quarterly cycles are mandatory across the fleet

Oracle’s policy states that updates are deployed over a three-month period for each cycle and that all customers must move to the latest version within that window. This keeps customers current on fixes and features without scheduling large upgrade programs. - Security patching and platform hardening handled by Oracle

Oracle documents that security patching is applied by Oracle on a recurring basis for the cloud platform, and that the provider secures the infrastructure and services that run applications. In dedicated materials, Oracle notes monthly security patching for Oracle Cloud Infrastructure services and outlines roles for SaaS security operations, including monitoring and web application firewall protections. - Continuous AI and automation capability in the suite

Oracle uses the quarterly cycle to release embedded AI and automation features across Fusion Applications. Recent updates highlight AI agents and assistants for finance and adjacent domains. Oracle’s official channels describe 25D roadmaps with increasing agent coverage and an Apps 2025 update noting hundreds of embedded agents and the AI Agent Marketplace. These are delivered through the same quarterly motion and align with the role model in Fusion. - Patching purpose and benefits

Oracle’s documentation on patching for Fusion Applications explains that continuous patch application closes vulnerabilities, fixes defects, improves performance, and adds features. This reduces incidents and keeps environments stable without customer managed patch programs.

Conclusion: Your Back Office Can Either Slow Growth or Support It

Oracle Cloud ERP gives finance and operations one source of truth with real–time reporting through OTBI, enabling leaders to act on current data instead of stale snapshots. Quarterly updates deliver features on a set of cadences with readiness guides and a test window before production, which reduces upgrade burden and speed adoption.

Ready to plan an Oracle Cloud ERP implementation that drives Financial close automation and Back-office automation without adding risk? Talk to VBeyond Digital. Our VBeyond Digital ERP services focus on outcome–led Cloud ERP solutions for measurable Oracle ERP benefits.

FAQs (Frequently Asked Question)

Oracle Cloud ERP implementation is the structured setup of Oracle’s SaaS suite for finance and operations. It covers establishing enterprise structures, ledgers, business units, taxes, banks, users, roles, data imports, and security, so that transactions, reporting, and controls run in one system. Oracle provides implementation guides and role-based access for project and security administration, which frame the work from pilot to go live.

Spreadsheets and aging stacks slow down the close and fragment audit trails. Manual data entry and offline reconciliations increase error risk and delay action. Oracle Cloud ERP replaces email-driven steps with in-application controls such as Close Monitor for period status and bank reconciliation rules, and it supports native invoice capture to cut rekeying. The net effect is faster posting and clearer accountability across the month.

Oracle Cloud ERP improves visibility through Oracle Transactional Business Intelligence for real-time analysis of transactional subject areas, in-context monitors for key balances, and pre-release readiness that keeps features current each quarter. OTBI reads live application objects, so dashboards reflect current activity. The update cadence also includes a test window before production to validate critical flows. Leaders get timely insight without waiting for batch refreshes or large upgrades.

Key outcomes include faster in-period decisions, shorter closed cycles, better spending control, and lower manual effort. Intelligent Document Recognition extracts invoice data directly into Payables, while matching links invoices to POs and receipts. Close Monitor tracks period status across ledgers, and quarterly updates deliver new features with published readiness content. These capabilities reduce rework and keep finance, procurement, and projects aligned on one record of activity.

VBeyond Digital focuses on outcome-led design and adoption. We align the chart of accounts, approval flows, and reporting with how leaders run the business, then set up OTBI subject areas, Close Monitor, invoice capture, and security roles. We also run a disciplined quarterly update rhythm using Oracle’s readiness guidance and the test to production window, so that new capability converts into measurable results with less risk.