Dynamics 365 Finance for Private Equity and VC Firms: Harnessing Copilot for Advanced Financial Forecasting

Section

Table of Contents

- Why VC and PE Firms Need AI-Powered Financial Forecasting

- The Financial Blind Spots Holding Back Portfolio Performance

- How Dynamics 365 Finance Equips VC and PE Firms for Smarter Portfolio Oversight

- Results for VC and PE Firms with Dynamics 365 Finance & Operations

- Implementation Considerations when deploying Copilot for Dynamics 365 Finance

- Conclusion

- FAQs ( Frequently Asked Questions)

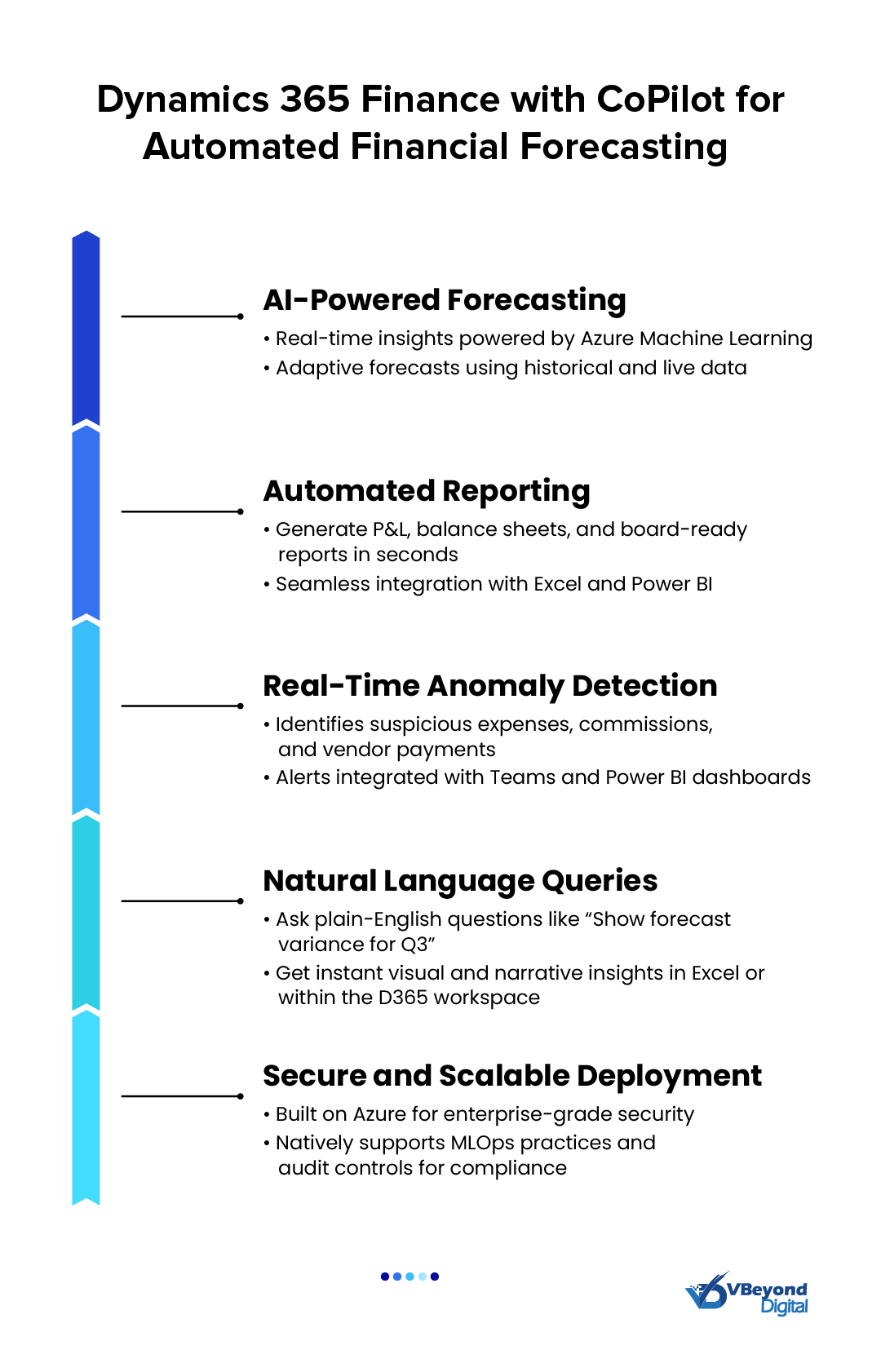

- AI-powered forecasting precision: Dynamics 365 Finance uses generative AI and Azure Machine Learning to deliver accurate, real-time financial forecasts across VC and PE portfolios—reducing manual errors and improving cash flow visibility.

- Automated, on-demand reporting: With Copilot, finance teams can instantly generate P&Ls, balance sheets, and board-ready reports directly in Excel or Power BI, slashing reporting cycles and improving consistency.

- Real-time anomaly detection: Built-in monitoring tools identify irregularities in expenses, commissions, or transactions—flagging risks early and ensuring financial compliance and governance.

- Natural language financial insights: Executives can query financial performance using everyday language within familiar tools, making data-driven decisions faster and more intuitive.

- Smooth adoption and scalability: Native integration with Azure and MLOps enables secure, scalable deployment, while change management and user training support long-term adoption across finance teams.

Private Equity (PE) and Venture Capital (VC) firms face constant pressure to deliver fast, data-backed financial insights across their portfolio companies. There are a wide range of dynamic requirements such as managing high-volume cash flows, monitoring investment performance, or preparing board-ready reports, traditional finance tools often fall short due to over-reliance on spreadsheets, siloed data, and delayed reporting cycles.

Dynamics 365 Finance & Operations, with generative AI, helps VC and PE firms automate financial forecasting, generate real-time reports, and detect anomalies. Features like Copilot enable faster decision-making in familiar environments like Excel and Power BI. This helps VC and PE firms improve portfolio management, de-risk financial planning, and support investment decisions with confidence, all while reducing the manual workload on their finance teams. Read more to know which areas of the business firms can transform with Dynamics 365 Finance.

Why VC and PE Firms Need AI-Powered Financial Forecasting

Challenges: The Financial Blind Spots Holding Back Portfolio Performance

1.Inaccurate cash flow predictions leading to liquidity issues

According to data from HighRadius, almost 90% of finance leaders rate their cash flow forecasting accuracy as unsatisfactory, reflecting a pervasive lack of precision. Private equity and VC firms, particularly those managing diverse portfolios, face significant forecast volatility in expected revenues, complicating cash flow planning and liquidity management. Miscalculations or guesstimates can erode working capital flexibility, restricting a firm’s ability to invest in candidate sourcing or board-level strategic initiatives.

2. Manual processes causing delays in financial reporting

Many firms still rely on spreadsheets and siloed systems to consolidate data from different platforms, causing delays which hinder prompt reporting and defer critical leadership decisions.

3.Difficulty in finding financial anomalies promptly

Periodic manual reviews struggle to surface subtle deviations in commission structures, expense claims, or vendor charges, leaving firms exposed to unchecked discrepancies.

Forecast smarter. Scale faster. Now.

The Financial Blind Spots Holding Back Portfolio Performance

1.Increased operational costs

When processes lack clear documentation, CFOs must spend time on tactical troubleshooting instead of strategic analysis, effectively increasing administrative overhead and impeding value-added activities.

2. Delayed strategic decision-making

Inaccurate reporting can have painful and costly consequences, including poor business and investment decisions, regulatory fines, and reputational damage, all of which stall strategic initiatives like leadership investments or service expansion.

3.Heightened risk exposure

Gaps in anomaly detection increase the risk of compliance breaches or unseen fraud, which can undermine client trust and lead to potential liability. Implementing real-time anomaly detection can significantly mitigate these risks by identifying irregularities promptly.

How Dynamics 365 Finance Equips VC and PE Firms for Smarter Portfolio Oversight

Dynamics 365 Finance & Operations with built-in Copilot offers VC and PE firms with capabilities that accelerate financial forecasting and reporting. Modules for AI-powered financial forecasting, automated financial reporting, real–time anomaly detection, and natural language queries via Copilot for Dynamics 365 Finance deliver board-ready data at unprecedented speed. Embedded predictive analytics in finance and integration with Azure machine learning for forecasting and Power BI for financial analysis simplify strategic planning and support AI-driven decision-making.

AI Capabilities That Give Large VC and PE Firms a Competitive Edge

1. AI-driven Cash Flow Forecasting

Generative AI in Dynamics 365 Finance uses historical ledgers and real-time transaction feeds to project cash flow with high precision over various time horizons. The models automatically retrain as actuals differ from projections, minimizing manual adjustments and enhancing forecast accuracy compared to traditional methods.

2. Automated Financial Reporting

Through Copilot for Dynamics 365 Finance, firms can generate extensive analytical reports, balance sheets, and P&L statements on demand or by schedule, cutting report preparation time by more than half. This automated financial reporting capability frees finance teams from routine aggregation tasks and ensures consistency across board and investor presentations.

3. Real-Time Anomaly Detection

Built-in real–time anomaly detection continuously scans expense claims, commission entries, and billing transactions, flagging deviations for immediate review. Alerts appear in Power BI dashboards and Teams notifications, enabling prompt investigation and reinforcing governance.

4. Natural Language Interaction

A sidecar interface, Copilot for Dynamics 365 Finance lets executives pose plain-English queries (e.g., “Show forecast variance by region”) and receive visual and textual answers within Excel or the Finance workspace. This conversational layer accelerates insight discovery and supports on-the-fly scenario analysis.

Built-In Integration for Scalable, Secure Financial Intelligence

1. Native System Incorporation

These AI features are built directly into Dynamics 365 Finance, requiring no additional connectors or middleware. Data flows securely within the platform, preserving role-based access controls and audit trails.

2. Azure machine learning for forecasting

Finance teams can use Azure machine learning for forecasting to build and deploy custom prediction models like those used in supply chain demand planning. This gives financial forecasts the same scalability, control, and accuracy as other Azure ML solutions.

3. Power BI for Financial Analysis

Power BI embeds directly into the Finance workspace, surfacing interactive dashboards and analytics alongside transactional data Users can drill from high-level forecasts into ledger-line details without switching applications, further reinforcing AI-driven decision-making at the executive level.

Results for VC and PE Firms with Dynamics 365 Finance & Operations

Accuracy Improvements

In financial forecasting, precision is paramount. Integrating Azure Machine Learning via Dynamics 365 Finance APIs delivers real-time, model-driven forecasts. This enhances decision-making processes and helps mitigate financial risks effectively.

Strategic Advantages

Beyond operational metrics, these innovations offer a distinct strategic advantage. Real-time visibility into consolidated financial ledgers fosters quicker board-level decisions and risk mitigation, with respondents noting improved decision-making agility thanks to real–time anomaly detection and AI-powered insights in Dynamics 365 Finance & Operations. Investment returns are compelling: a Forrester TEI study recorded a net present value of $3.41 million and a 122% ROI over three years, underscoring the value of modernizing financial forecasting processes.

Implementation Considerations when deploying Copilot for Dynamics 365 Finance

Data Readiness

Prior to implementing generative AI for AI-powered financial forecasting, firms must ensure data is AI-ready—that is, accurate, complete, and structured consistently across ERP, CRM, and billing systems to feed predictive models in Dynamics 365 Finance. Establish data governance principles—defining master-data rules, appointing data stewards, and enforcing quality controls—to support reliable automated financial reporting and set up checks and measures for regulatory compliance within the finance application. Implement ongoing data-cleansing, validation, and monitoring routines to prevent model drift and reinforce confidence in predictive analytics in finance and real–time anomaly detection features.

Scalability

As transaction volumes grow, AI models must scale to process large datasets without performance degradation. Adopt MLOps practices and Azure machine learning for forecasting endpoints to automate retraining, version control, and deployment pipelines in Dynamics 365 AI environments. Use the data-management framework native to Dynamics 365 Finance & Operations to manage entities, data packages, and integration patterns, ensuring that predictive analytics in finance workflows meet throughput and latency targets at scale.

User Adoption

Successful rollout of Copilot for Dynamics 365 Finance and Power BI requires targeted training programs covering generative AI workflows, query crafting, and interpretation of AI-driven decision-making outputs. Implement change-management practices—regular communication, executive sponsorship, and hands-on workshops—to build trust in AI-generated forecasts and encourage use of automated financial reporting across finance teams. Measure adoption metrics such as the percentage of staff using predictive analytics in finance or the frequency of Copilot queries to identify skill gaps and refine ongoing enablement.

Conclusion

The future of financial leadership lies in intelligence that anticipates, not reacts. For PE and VC firms navigating volatile markets, the ability to see around corners is fast becoming the ultimate differentiator. The competitive advantage is clear. Firms using Dynamics 365 Finance aren’t just improving operational efficiency, they are also transforming FinOps and financial management strategy in such a high-stakes environment. With measurably high accuracy, minimized manual input in repetitive tasks, and new levels of visibility, PE and VC firms can focus on their core mission without worrying about digital transformation. As artificial intelligence continues to evolve, the firms that embrace these technologies today will be the market leaders of tomorrow.

FAQs (Frequently Asked Question)

Dynamics 365 Finance provides a unified financial management platform enhanced with generative AI and real–time insights. For VC and PE firms managing multiple portfolio companies, it offers faster, more precise forecasting, automated reporting, and built–in anomaly detection, which are key for streamlining oversight and driving value from finance operations.

Generative AI in Dynamics 365 Finance analyzes historical ledgers and real-time transactions to forecast cash flows and budgets. These models continuously retrain, reducing manual adjustments and enhancing forecast accuracy.

Yes. The platform includes real-time anomaly detection capabilities that scan expenses, commissions, and vendor payments for unusual patterns. This helps firms spot fraud, compliance risks, or financial errors early—before they affect board reporting or close cycles.

Copilot for Dynamics 365 Finance allows users to ask natural language questions (e.g., “What’s the forecast variance for Q3?”) directly in Excel or the finance dashboard. It generates visual and narrative insights instantly, minimizing manual work and formulas.

Before rolling out AI capabilities, firms should ensure that their financial and operational data is clean, consistent, and well-governed. Structured integration across ERP, CRM, and billing systems is essential to support reliable predictive modeling and automated reporting.

Yes. Dynamics 365 Finance supports custom Azure ML forecasting endpoints, enabling you to train, version, and deploy specialized prediction models using MLOps practices. These endpoints plug into your finance dataflows, ensuring governance and scalability alongside native AI forecasting features.